In modern ‘bootstrap’ culture, the idea of being financially self-compassion is misunderstood. It is often confused with self-pity or self-indulgence. Being financially self-compassionate is an opportunity to take responsibility for your mistakes and to do so without bullying yourself. It is something that all folks can benefit from because money affects all aspects of our lives. Increased compassion for ourselves and our money improves compassion levels in other areas of our life.

Being financially compassionate to oneself is neither pity nor excuse. It is recognition that what you are facing is hard, that you are not alone in your struggle, and that you deserve to be treated with kindness. Learning to know better by becoming financially literate is separate from doing better. They are two different skills and self-compassion can be the bridge.

One of the foremost researchers of self-compassion is expert Dr. Kristin Neff. In her book ‘Fierce Self-Compassion’, Dr. Neff describes three core elements of self-compassion. The elements are mindfulness, common humanity, and kindness. Each of these elements can easily translate to finances in different ways.

Mindfulness: Be. Here. Now.

We live in a fast-paced world with endless messaging that managing money is hard, and it can sure feel that way. Money mindfulness is being present with your money. To observe your habits and the hardships that go with that relationship. To be mindful financially is to act as an unbiased witness to your finances and all the decisions you have made.

Making an informed and confident decision about how to move forward requires using a lens of non-judgment. Money, in Western culture, affects all kinds of relationships – friendships, family, work and with ourselves. It is very easy to over-identify as your financial position, status, or failure. This makes it very easy to judge yourself when your financial plan falls off track.

Despite what our inner voice may say sometimes. You are not the choices you have made. Your worth is not a reflection of the dollars in your account.

Mindfulness can also interrupt high-risk financial mindsets. Mindsets like the fear of missing out, fatalism, and loss aversion. The act of slowing down to consider the impact of a purchase decision will reduce spending. Additionally, it can reduce your risk of falling for a scam or the latest financial fad.

To begin practising mindfulness, approach your money with curiosity. Ask yourself questions about where you are. Sit with this information without immediately looking for solutions. Validate the emotions that come up. When judgmental thoughts arise, thank them for their concern, and try to let them pass. This information is neither good nor bad, and right now your task is to simply observe it.

Common Humanity: You Are Not Alone

You are not the only person to carry credit card debt, need a consumer proposal or, file for bankruptcy. You are not the first or the last to fall victim to a financial scam or wait until it feels too late to start investing.

Fear of being judged for our financial choices prevents so many people from getting the help they need. Often, it is our own internal criticism that holds us back. Confirmation bias can further isolate families and individuals from getting help and making progress. Know that you are not alone.

The 2022 Financial Fitness Index is a decade-long study measuring self-assessed financial capability. The study was carried out by the Canadian Association for Credit Counselling Services (CACCS) and Environics. It highlights that over the last ten years, the majority of Canadians live cheque to cheque or worse.

Average credit card debt for Canadians is climbing.

Inflation coupled with stagnant wages affects the majority of the population. Your money struggles are not unique.

Kindness: Treat Yourself How You Treat Others

The third element is the more obvious and yet can be the most challenging – kindness. Other people are often the recipients of our understanding and encouragement. There is a reluctance to turn kindness inward, despite the well-known benefits. When faced with a mistake or a failure we often turn to criticism. We tear ourselves down in the privacy of our own minds. Bullying ourselves knowing we would not speak to a stranger that way, let alone a friend.

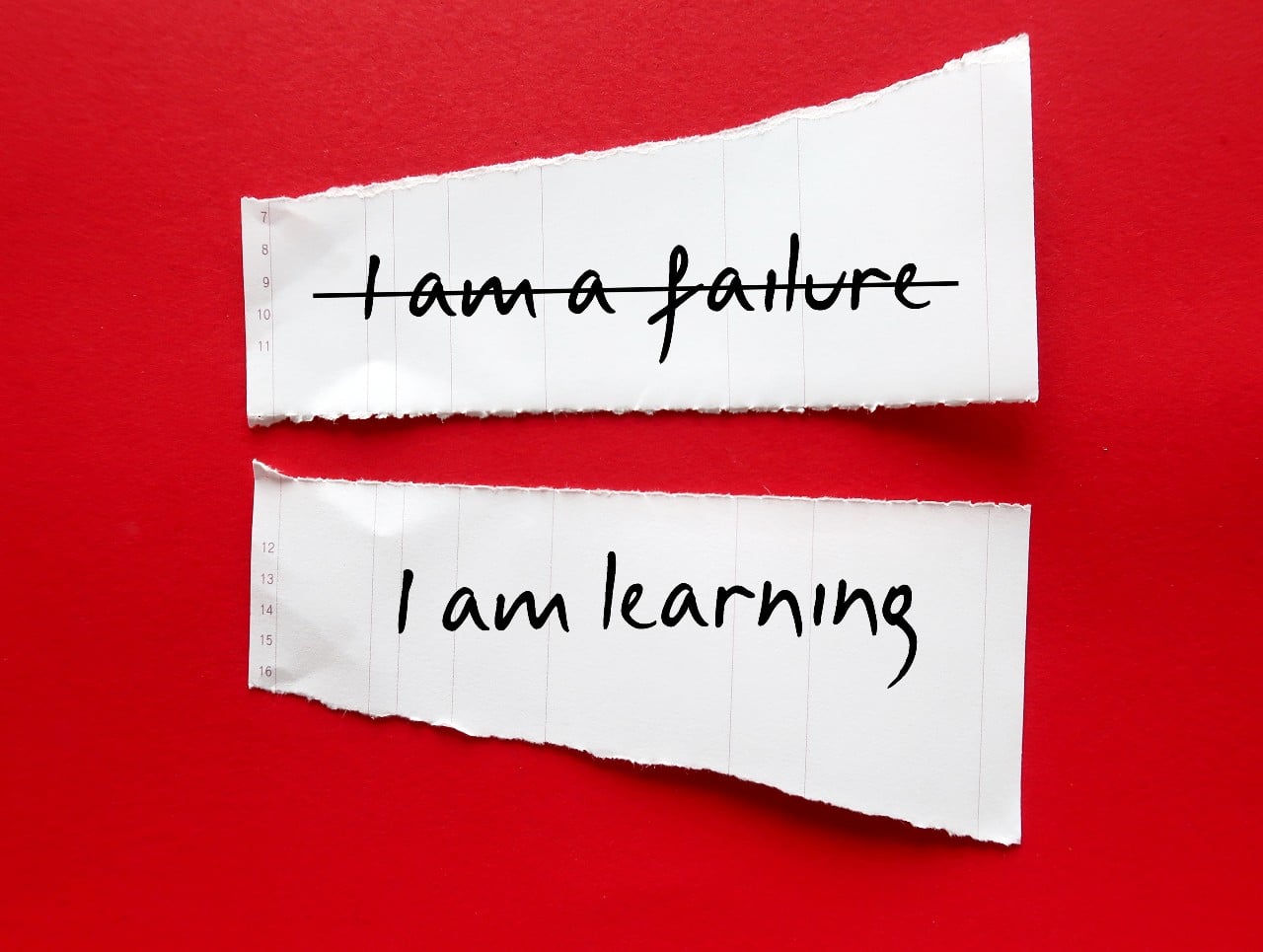

Most often the cruel things we tell ourselves are untrue. We are not failures, stupid, or undeserving if we mess up with our money. Money management is not an innate skill, but kindness is. We have access to giving and receiving kindness and we above all else deserve to receive our own.

In order to take action toward a lasting and meaningful change we must befriend ourselves. Approach challenges and failures with curiosity, encouragement, and grit. If we replace our self-criticism with self-compassion our accounts will grow. Our willingness to try again will improve. Its impact will help us flourish and then ripple out to people around us to help them too.

Putting It All Together

Step 1: Mindfully affirm your feelings without expectation or judgment.

“I am feeling regret, my heart feels heavy and I feel kind of hopeless”

Step 2: Acknowledge your common humanity.

“Everyone struggles with money in their own way. I’m not the only one who feels this way and there are people who can help me”

Step 3: Treat yourself with the loving kindness you would give a friend.

“I’ve done my best to this point. I made the choices that I thought were best with the information I had. Paying attention to my money is new for me and I am capable of learning new skills and taking action. I have the power to change this situation”

You won’t always make the right choices. Your mistakes will need resolution. Being financially self-compassionate means approaching your money with mindfulness, humanity and kindness. Doing so means you’ll be able to take responsibility for your mistakes without taking those failures on as your identity. Mistakes are not a representation of who you are or what you are capable of. Approach your budget, your debt, and your savings with loving action. You can ask for help and relieve your suffering. You deserve to improve your financial position, in balance with your emotional well-being. Remember that learning requires repetition. Mess up, acknowledge the mistake, compassionately adjust and try again.