Technology has been changing the way people connect with each other since the invention of the telephone. Then, the internet was thrown into the mix. The amount of information we could receive grew at an unimaginable pace. Over the years, there’s been a rise in social media sites such as YouTube, Instagram, and TikTok. We’ve become an audience to the lives, opinions, and ideas of billions of strangers every day. With the amount of time the average person spends on these apps and websites, it’s no wonder it has an impact on our financial health.

Social media’s influence on finances

It may come as a surprise to some people just how intertwined social media has become with the way we spend our money. Many of the effects are so subtle you might not be aware when you decide to purchase something because of what you saw online.

Each second, there’s someone posting about a new shirt they bought, a girl’s trip to a tropical country, or the meal they had at a 5-star restaurant. Whether you realize it or not, consuming this kind of content encourages you to spend in similar ways, often subconsciously.

Even if you don’t personally follow any influencers, the advanced algorithms these sites use have a way of exploiting data. From the posts you interact with to push the kind of content that would get you to spend money onto your feed.

The impact social media has on mental and financial health

A lack of financial wellness on its own has adverse effects on people’s mental health. When people experience money problems it can lead to sleepless nights, anxiety and depression, among other things. The use of social media has contributed to several factors that lead to financial stress, including:

Social pressure

When we see posts online, it’s easy to forget that most people only showcase the best, most “insta-worthy”, parts of their lives. We find ourselves wanting to live up to that same image. When our income doesn’t fit the bill, it may make us feel that we are lacking in our lives.

Impulse buying

With algorithms that cater to your most niche interests, the urge to click the link and purchase an item can be hard to fight. Social media endorses a form of fast-paced consumerism. It leads to people reaching for their credit cards the moment they see something they like. Online shopping has become so easy. Many don’t stop to think if you can really afford what you’re buying. Falling into this trap often puts you at risk of accumulating large amounts of debt.

Fear of missing out (FOMO)

Though this experience was not created by social media, it is surely exacerbated by it. There’s pressure to keep up with peers and advertise the life you want people to think you have. A study Credit Karma did in 2019 states half of millennials went into debt to keep pace with the habits of their friends. Many young people only earn enough cash to make ends meet. Unless you can say no to going out once in a while, a mountain of credit card debt will be unavoidable.

Bad Financial Advice

These new channels of media have people wanting quick access to information. Self-proclaimed gurus offer “help” to the masses, feeding them advice on financial goals and health. It’s best to wary, often lacking or giving incorrect details. In addition, many of these gurus are not properly certified to give legitimate financial advice.

The Negative Side of Social Media in Finance

Mental health is just one way finances can be negatively impacted by social media. Consumer debt in Canada is reaching an all-time high. The impact of social media is adding to the problem. Many of the videos we watch have the creator addressing the audience directly. Their dialogue is conversational. They look at the audience as if they’re there. This creates a parasocial relationship, which means our brain can’t tell them apart from any other peer. It makes us more likely to trust and value their opinions. This can make it harder for us to take control of our own finances because we find ourselves relying on the advice of others.

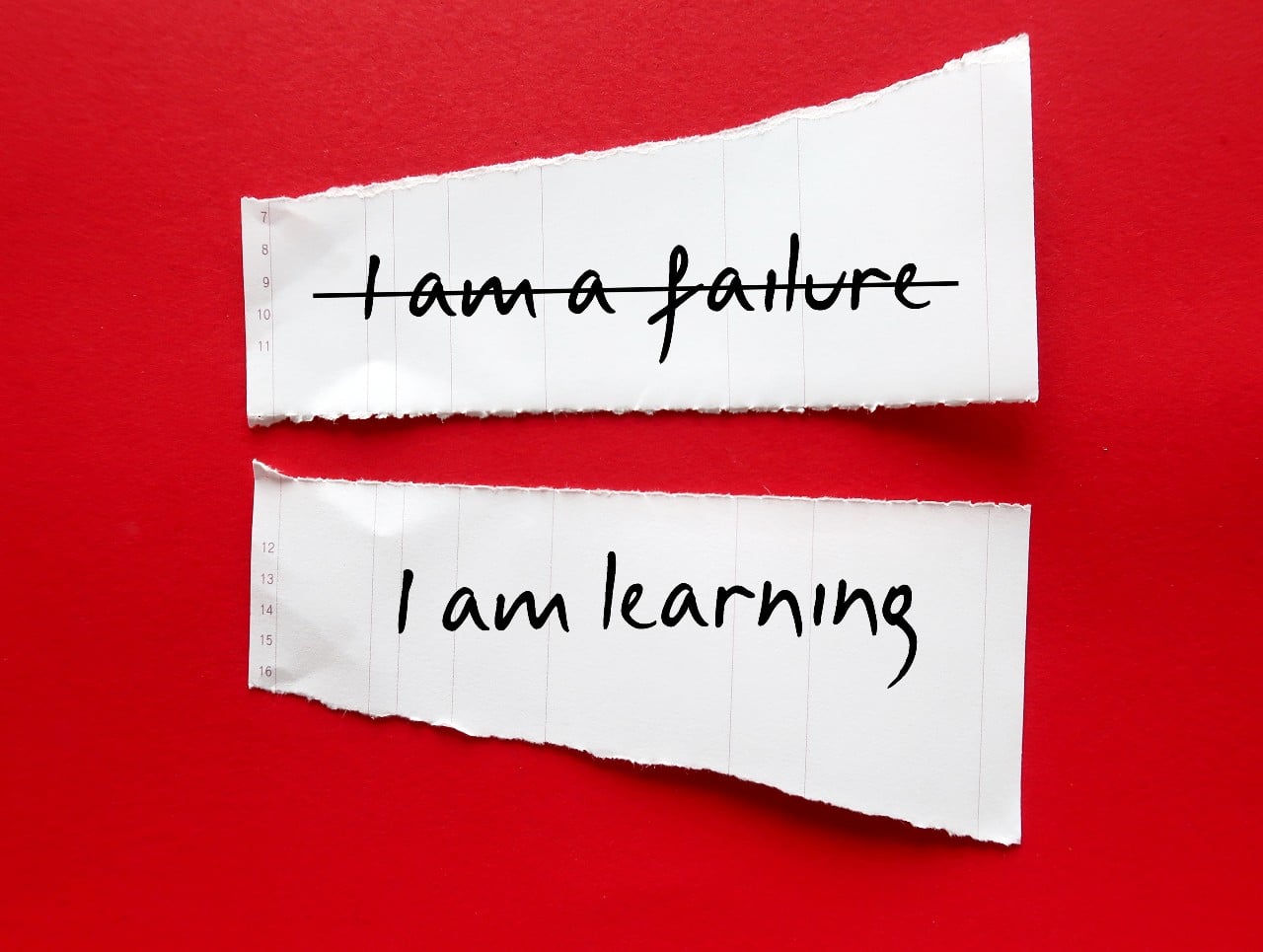

You can curb the negative effects of social media by being diligent about what you consume. Vet the people you follow so the information you get comes from high authority. The best thing you can do is improve your own financial literacy. By making your own financial plan, or using an online budget planner, you set solid expectations for yourself. These help you stay on track financially regardless of what you see online. A savings account will also prevent social media from dragging you into debt. Whether it’s an emergency fund or retirement savings, you should always dedicate a portion of your income to your future.

It’s Not All Bad

In fact, some of it is really good!

One big benefit of the way we find products through social media is having access to real and honest reviews by everyday people. True, you can never be too sure about whether an influencer genuinely likes the product they’re promoting. Anything popular or trendy will have a long list of video reviews by regular people of all backgrounds.

There are also ways you can use social media to your benefit. Following brands you like can give you access to deals and offers. This way, you can get what you want at a discounted price. If you use your credit card to make the purchase, just make a habit of paying it off right away. Not only will it prevent debt but also improve your credit score.

Conclusion

Consuming social media is now a cultural staple. Even if it wasn’t, not many people would be willing to give it up. By being aware of how content can affect your habits, you can take the right measures to keep yourself debt-free.

At debt.ca we have a wealth of financial services and tools, such as financial calculators, available to help you create a personal budget. These resources will help you stay financially healthy while also taking pleasure in some of the finer things in life.