Consumer proposals are a highly effective debt solution you can do along with the help of a Licensed Insolvency Trustee.

Ready to move forward? To help, below are the answers to the most common Consumer Proposal FAQs.

A consumer proposal is a legally binding debt settlement arrangement. It is an alternative to filing for bankruptcy and is an effective debt relief strategy.

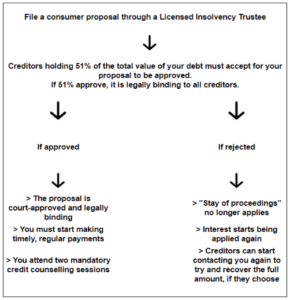

A consumer proposal is filed through a Licensed Insolvency Trustee, and can often reduce your total debt owing by 70 to 80%. It is legally binding on all your creditors, once the creditors who hold more than 51% of the total borrowed sum vote to approve your proposal.

If you’ve already filed a consumer proposal before, but find yourself struggling with debt again, you may wonder if you can file again. The good news is, you can file unlimited consumer proposals. There is no set limitation on how many times you can file a consumer proposal in Canada.

You would still need to meet the general eligibility criteria. The effects on your credit score would be the same as the first time round, staying on your report approximately three years after paying off the proposal. There is no penalty on filing again.

You can apply for a mortgage at any time, even while your consumer proposal is still on. However, due to a consumer proposal’s effects on your credit, you may find it difficult to be approved for a mortgage. If you do, chances are your interest charges will be very high.

Typically, it is advisable to wait for at least 2 years after your credit report is clean again before applying for any sort of loan. This is because your credit score can affect your interest rate. A consumer proposal also adds an R7 rating on your credit report, which stays on for 3 years after you’ve paid it back in full.

If you’re making your payments on time and in full, you would be able to renew your mortgage with your financial institution. Filing a consumer proposal is unlikely to affect this. In fact, chances are that your existing institution would not require a new credit application for a renewal.

If you opt for refinancing, on the other hand, credit reports and fresh applications come into play. This also means that your chances of getting a lower interest rate are unlikely.

A consumer proposal does tend to affect your credit score and finances, making it less likely for you to get a loan at a good rate. However, if you can show that you’re making payments on your proposal regularly and show that you have the cash flow to pay back the new loan, you may just get approved!

You are more likely to be approved if you can show steady income, proof of stable employment, and history of timely payments. Your trustee can work with you to ensure you apply for a loan that you can genuinely afford to pay back.

While it is possible for you to apply for a new credit card, your chances of approval are less. This is because when you apply, they will check your credit, and the consumer proposal will show up. Your credit score would be quite low with an ongoing consumer proposal. This might make them wary, or you may be charged a higher APR on your new card if approved.

An alternative would be to try and get a secured credit card from a lender – for which you may have to put up some collateral, like putting down a security deposit or setting up a GIC.

You can, as long as you’re not carrying a balance on them while filing the proposal! You should ideally be at around 30% to 35% of credit utilization, and pay back in full and on time every month. This will show lenders you’re financially on track and you can start building up your creditworthiness, and eventually your credit score.

It’s a great way to start countering the damage that a consumer proposal would do to your credit score.

You are allowed a maximum of three missed payments through the duration of the consumer proposal. Once you reach three defaults, and don’t file an Amendment, the consumer proposal is considered void. By not making payments, you would have broken the terms of the proposal.

Due to this, your creditors are not bound to the terms anymore either. Since the consumer proposal is no longer legally binding, they can directly pursue you for the full amount.

For your consumer proposal to be rejected, creditors who hold 51% or more of your total debt amount would have voted to reject your proposal. The “stay of proceedings” will stop on rejection, and they can start applying interest again. They can also pursue you for the full amount again.

To avoid this and increase your chances of approval, work closely with a Licensed Trustee to create a proposal with terms that are agreeable to your majority creditors. It would also be in your favour to show that these terms are the best you can do – after all, they do want to recover as much as they can.

If you’re offering much lower funds overall, or a disagreeable payment schedule, your proposal may be rejected. If your financial history and spending patterns show a lack of financial responsibility, creditors may be wary of your commitment to improving your finances, and may also lead to rejection.

The good news is that well-thought-out and structured consumer proposals are usually accepted. It is advisable to work with a Licensed Insolvency Trustee to put together a well-crafted proposal that creditors would be likely to accept.

You absolutely can! If you find yourself with some extra funds or a bonus from work, you can put it towards the consumer proposal payment. Apart from one-time infusions, you can also increase the frequency or amount of your payments.

This will help you get out of debt sooner and rebuild your credit score. The sooner you pay off your consumer proposal, the sooner it will drop off your credit report too.

The cost of a consumer proposal consists of two parts.

The first part is variable on a case-to-case basis and depends on:

- Your income, and any surplus income (as calculated by the Bankruptcy and Insolvency Act in Canada) you would pay in a bankruptcy,

- Assets you own that would have to be surrendered in a bankruptcy,

- The creditors you owe money to, and the outcome they are expecting from the proposal.

Your Licensed Insolvency Trustee will also look at your finances and negotiate with your creditors based on what you are able to reasonably afford.

The second part is a standard fee for every consumer proposal. As of Feb 2024, these fees are:

- $104.03 OSB (Office of the Superintendent of Bankruptcy) filing fee

- $750.00 plus sales taxes upon filing of your consumer proposal

- $750.00 plus sales taxes once your consumer proposal has been approved by your lenders/creditors

- $170.00 plus sales taxes for two mandatory financial counselling sessions as part of the consumer proposal process

- 20 percent of funds distributed from trust account plus sales taxes

All these costs are combined into the one monthly payment, where the amount is finalized as per the consumer proposal agreement.

A consumer proposal in Canada is an agreement between you and your creditors. It is a legally binding document that states you will pay back part of what you owe, with the remainder being forgiven. It covers various forms of unsecured debt.

You will file a proposal with the help of a Licensed Insolvency Trustee, and your creditors vote to accept or reject it. If creditors who hold 51% of the total value of your debt choose to accept your proposal, it will be accepted and legally binding to all.

A consumer proposal combines multiple payments into a singular monthly payment with a fixed amount. Your total amount owing can be reduced by up to 70% or 80%. A consumer proposal will reduce your debt as well as consolidate it into a single payment.

However, a consumer proposal differs from debt consolidation, which is a separate debt management solution. With debt consolidation, you still need to pay the full amount, just with a lower interest rate. It also does not affect your credit score as negatively as a consumer proposal would.

A consumer proposal has many benefits compared to bankruptcy.

- Your assets and income are protected, so nobody can garnish your wages or lay claim to assets you already own free and clear.

- You will no longer be charged interest on any debts that are included in the consumer proposal.

- You will find it relatively easier to rebuild your credit history and fix your credit score with a consumer proposal, as compared to bankruptcy.

- Consumer proposals also have the advantage of not changing based on your financial situation. This means, if your financial situation improves, you won’t have to pay more. You will still be paying the same amount that was agreed upon during the consumer proposal. With bankruptcy, a re-negotiation would happen.

If the only debt you hold is unsecured debt, and everything was included in the consumer proposal, you could be fully debt-free once it is paid off! So yes, you can be fully debt-free, as long as you ensure no other debt is taken on during the term of your consumer proposal.

Once you’ve finished making all the payments, you will receive a certificate that states you have fulfilled all the terms of the proposal and that you do not owe any more balances.

Under exceptional circumstances, creditors may consider an amendment to the consumer proposal. There needs to be a valid reason for them to consider it, so make sure you follow complete transparency and share your extenuating circumstances with your trustee. They will help you figure out whether you can add more debt to your consumer proposal through an amendment.

If you file an individual consumer proposal, this does not affect your spouse financially. It will not affect their credit score, nor will they be liable to make payments on your debt. Under the terms of a consumer proposal, creditors cannot go after your existing assets, joint or otherwise.

However, if you have any joint outstanding debt, they are still liable for it, and collections can continue to call and pursue them for that. If you are holding debt jointly and want it to be cleared as well, you will need to file a joint consumer proposal. If you do so, your spouse would experience the same impact of a consumer proposal as they are filing it with you.

Yes, you can file a consumer proposal jointly with your spouse. If your spouse is also affected, or if you have household debt, it may make financial sense to file jointly. If you do, collections would not be able to pursue your spouse for payments as they are also part of the proposal and the terms will be binding to both of you.

For a joint proposal, you can file for up to $500,000.

As it is a legally binding document, creditors may not accept a proposal that has been filed improperly or incorrectly. That’s why it is not possible to file a consumer proposal by yourself. You have to go through a Licensed Insolvency Trustee. They will help you craft a proposal that appeals to your creditors and that they would be likely to accept.

Yes, you can file a consumer proposal more than once in Canada. There is no legal limit on the number of times you can do so. You still need to meet the eligibility criteria, just like you did for the first one. The impact on your credit score will be the same as the first time.

You cannot have two active consumer proposals simultaneously. It is certainly possible to apply for a new one if you find yourself in debt again after you have fully paid off the first consumer proposal and received the certificate stating you have paid off your consumer proposal in full.

Yes, collections will have to stop calling you as soon as you file a consumer proposal. When you file, you are issued a “stay of proceedings”. This means that creditors are not allowed to contact you or continue charging any interest to you.

If your proposal is approved, this rule continues. In case it is rejected, the “stay of proceedings” will stop and they can start charging you interest and calling you again.