The snowflake method is a debt repayment strategy, one of many popular strategies used to reach the goal of a debt-free life. This method involves putting small amounts of money, on a frequent basis, towards debt payments. This approach focuses on micro-savings, as every little bit certainly counts, especially when you’re trying to pay off debt. Just like snowflakes being tiny by themselves, but when you put a lot of snowflakes together, it makes everything snowy before you know it!

The snowflake method involves taking small actions in everyday life that help save money. Over time, these seemingly minor changes can make a huge difference in outcome, even reducing your payment duration or total interest paid.

Key benefits

Consistency

With the snowflake method, you can make a real difference every day. Seeing this change on a regular basis will help you stay consistent and on track for repayment. Just taking action, however small, can help you maintain this habit.

Low pressure

This is one of the most low-pressure debt repayment strategies. The snowflake method requires no structured payment plan, schedule, or goal amount to reach as soon as possible. It simply requires conscious decisions and a consistent approach. There’s no “target” to reach, so you can take it easy because every bit truly does count here!

Mindful

This debt repayment method encourages awareness, by really paying attention to your purchases. When you make conscious decisions for greater potential savings, you will also feel more in control of your financial choices. This is a powerful benefit of mindful spending as a whole, not just the snowflake method!

Flexible

Since the snowflake method is low pressure, it can be combined with other debt repayment strategies, like the debt snowball or debt avalanche method. This combination is especially helpful if you’ve set a goal or timeline for paying off your debts. In the debt snowball method, you pay off your smallest loan first, then continue with larger loans. Meanwhile, you make the minimum payments on the rest. With the debt avalanche method, you start by paying off your highest-interest loan first, working your way through the list to the least expensive (lowest interest) loan.

How does it work?

The first thing to do is identify small saving opportunities in your daily life. They might be small changes to things you do, or simply changing the way you approach them. Finding inexpensive alternatives, or being more mindful about impulse purchases are some ideas to keep in mind as you go about your current lifestyle. Seeing it from that perspective can help you identify areas where you can incorporate this method more easily.

The next step is redirecting these savings towards your debt payment, even if it’s a small difference. It all adds up over time. Try to keep this amount separate from your regular checking account. Make a separate allocation in your savings account, if that helps. The key is to remember it is not accessible as “spending money”. Debt repayment can be a difficult, time-consuming process, so it’s important to stick to your goals. If you think it will be hard for you to maintain these funds in your savings account, you can just pay it directly towards your debt instead.

Make these micropayments frequently. For example, you could make these payments directly to your credit card on your bank app. Even a savings account, as mentioned above, could work for saving the smaller transfers till you want to make a debt payment. Either way, make sure you’re transferring the saved amount every month by the due date, so you can start seeing results regularly. Any additional payments over the minimum payment will contribute towards paying off the principal amount over time.

See it in action

Let’s start with an example of common debts people usually carry.

| DEBT TYPE | BALANCE | INTEREST RATE | MINIMUM PAYMENT |

| CREDIT CARD 1 | $10,000 | 22% | $230 |

| CREDIT CARD 2 | $3,000 | 24% | $100 |

| STUDENT LOAN | $3,500 | 3% | $45 |

| CAR LOAN | $4,000 | 8% | $130 |

| TOTAL | $20,500 |

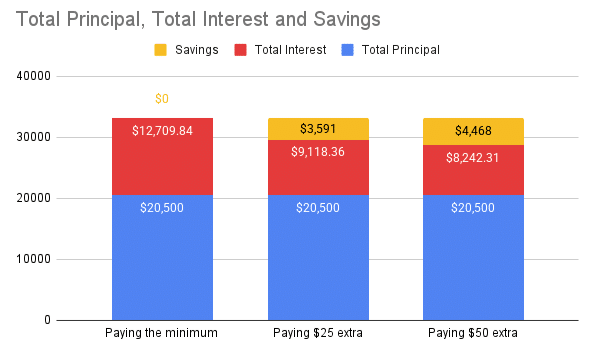

If you pay the minimum, you will be paying a total interest of $12,709.84 by the time you have paid off your debts. Now, see how much you can save in interest payments by paying just $25 or $50 extra per month towards your bills.

Chart 1 shows that an extra $25 or $50 a month can greatly affect your overall interest payments. With $25 extra per month, you would save $3,591 in interest payments! If you can ramp that up to paying $50 extra every month, you would save $4,468 in interest. That’s certainly not a small amount by any means.

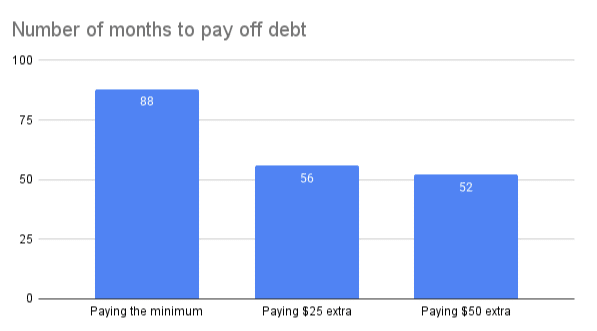

Plus, these extra snowflake payments don’t just save you money – they also save you time.

Tip: Adding the snowflake payments to your highest-interest debt first can save you the most money!

Chart 2 shows how much time you can save with extra snowflake payments. By paying the minimum, you would need 7 years and 4 months to pay off your debt. With an extra snowflake payment of $25 every month, you can pay off your debt in just 4 years and 8 months! With an extra payment of $50 monthly, it drops further to 4 years and 4 months!

Snowflake method: How to do it

Here are some examples of the changes you can make or ideas you can consider incorporating. Pick and choose whichever “snowflakes” appeal to you. You may even find some inspiration for your own version of these examples!

Food and Grocery

- Skip the coffee shop and make your own! If you must buy your daily coffee, get a medium or small instead of a large one.

- Ask for water instead of buying a drink at a restaurant. Water is healthy and (mostly) free!

- Pack your own lunch instead of getting takeout. If you do already, try to ramp up the number of days you pack a lunch. If you don’t, try starting with one or two days at a time.

- Make use of cashback programs and apps, like scanning your bill to get points or money!

- Here’s an experiment: buy store brand instead of name brand when possible, as long as you like it! You may find that some store brand replacements are great, and some are not as good as the real thing. You’ll only know what makes the cut for you when you try it. Give it a real shot: and if you really don’t like any of the alternatives, feel free to skip this step.

Declutter

- Sell your unused items and declutter your space. You’ll gain money, and space in your home! A clutter-free home can also support your peace of mind – talk about a win-win!

- If, while decluttering, you find a lot of items that you’re ready to say goodbye to, consider having yard sales or garage sales. Whatever money you make can go directly towards your debt payments.

- If you’re feeling crafty, you’ll like this one. For things that can have a useful extended life, try to DIY, repurpose, or upcycle them.

Free or affordable activities

- If you have the space in your schedule, look into small side gigs like dog walking, freelance opportunities, or even gig work. All the money you make from these can go directly towards debt payments.

- Use the public library instead of buying or renting books and movies. It’s free, you get a huge variety of options, and you’re supporting your public library in the process!

- If you enjoy watching streaming services, share streaming subscriptions with friends and family to reduce the cost. If you’re not using them often, cancel the ones not often used. If you have multiple subscriptions going on every month, take a look at them objectively. See if you can cut down on how many you have. For example, if you have many subscriptions to watch TV shows and movies, see if you can subscribe in rotation. This means you can sign up for one or two, watch what you want, and cancel it. Then you can subscribe to the next one, watch the shows there, and repeat. This way, you can still use all your subscriptions, while not having to pay for so many every month.

Plan well to save more

- Plan and batch errands to save time, gas, and impulse spending. An added benefit is saving your time and finding more efficient ways to do your errands. These are habits that will support you in the long run, as you build a debt-free life.

- Challenge yourself with no-spend days. Make a note of every time you want to make an impulse purchase throughout the day. At the end of the day, all the money you chose not to spend can go towards your savings account or debt micropayments.

- Make a change jar: add loose change and small bills. Before you know it, the jar will start filling up.

Many of these options may look like small choices and small numbers. The beauty is that over time, these small amounts can add up to make a big impact on debt reduction.

Make it more effective: tips

- Set up a separate savings account to transfer the money each time you make a saving decision. Out of sight is out of mind is certainly true in this case, so take advantage of it. If possible, you could even transfer the funds directly to your credit card payment through the bank apps.

- Set up automatic transfers for recurring savings. Pick an amount you’re comfortable with, that you know will not affect your necessary expenses. At the end of the month, transfer it towards debt payments, or use it to build an emergency fund.

- Combine with other methods, like the snowball method or avalanche method of debt repayment. This can accelerate the time it would take to become debt-free.

- Focus on one debt account at a time to see the results sooner. Since you’re making micropayments, it’ll be easier to see the effect if you focus on a single account. This can also be quite encouraging!

Key takeaways

The snowflake method is one of many popular debt repayment strategies. In this method, you put aside small amounts of money towards debt payments frequently. These micro-savings add up over time and can make a big difference in your timeline towards being debt-free. The key benefits of this method are consistent action, low-pressure modifications, and enhanced mindfulness about your spending patterns and choices. Over time, these micro-payments above your minimum required payments can make a big difference. Every bit counts, and with the snowflake method you can see this in action. If you’re currently dealing with debt, you can contact one of our trained credit counsellors for advice – they can help you figure out which debt relief strategy could be the right fit for your specific situation.