Debt Relief Solutions in Edmonton, Alberta

Residents of Edmonton have reduced their payments by up to 50% by contacting Debt.ca for help.

For Edmontonians struggling financially, Debt.ca will evaluate your situation and refer you to qualified and vetted professionals based on the solution that will work best for you.

Reduce Your Payments By Up To 50%

Lower Your Interest Rates

Make One Low Monthly Payment For All Your Debt

Debt Free in as little as 24 – 48 Months

Canadian Debt Relief

Credit Counselling

Debt Management Plans

Debt Consolidation

Consumer Proposal

Bankruptcy

Not Alone

Debt.ca is Canada’s trusted source for debt relief

At Debt.ca, we understand that people might find themselves surrounded by debt for many reasons including job loss, reduced income, or even the increasing costs of raising a family. In fact, the average household debt in Canada is the highest among all of the G7 countries. Edmontonians are no exception. They’re dealing with a lot of debt, sometimes even for their day-to-day expenses. The total consumer debt in Edmonton, as of Q4 2023, reached $23.6 billion, excluding mortgages. Including mortgages, this number increases to $77.8 billion.

When faced with a mountain of consumer debt, it is quite easy to become overwhelmed and believe that you will never be able to pay off your creditors. The high interest rates associated with consumer debts, late fees for those who are behind on their payments, and much more can seem to conspire against your attempts to become debt-free. That is why we want to help all Edmontonians better understand their debt relief options and save the most money while they get out from under their unsecured loans.

CREDIT COUNSELLING HELP IN EDMONTON, AB

For the past several decades, consumer debt throughout Canada, overall, has been on the rise. Edmonton is one of the few exceptions. The average debt, including mortgages, in Edmonton in 2023 is $76,689 per capita. This is a 5.71% decrease since 2019. However, the Albertan capital city still ranks 16th in the country for per capita consumer debt. While things are improving for Edmonton’s economy, there is still a long way to go for Edmontonians dealing with personal consumer debt. People, including residents of Edmonton, rely on debt for help when they need the funds to make ends meet, and if income doesn’t keep up with inflation.

That’s why finding credit help in Edmonton is a priority for many individuals. Speak to one of our credit counsellors to discuss your financial situation. They’ll explain the various debt solutions we offer and what solution would be best for you. If your overall debt levels increase month after month, then credit counselling in Edmonton may be your best option. A quality Edmonton credit counselling program can help you get out of debt and improve your financial future at the same time.

WOULD A DMP WORK FOR RESIDENTS OF EDMONTON, AB?

Debt management plans and debt consolidation often get confused. As of Q4 2023, Edmontonians owe $4.55 billion in credit card debt alone. To help handle this amount of debt it’s important that they know the difference so, if need be, they know which option is best for their financial situation.

There are many similarities between the two rograms. For instance, both programs entail converting several debts into one monthly payment for ease of tracking. However, you still owe the original creditors when you enroll in a debt management plan (DMP). Conversely, you only owe one entity when you participate in a debt consolidation loan. If you’re considering a DMP in Edmonton, you must have a steady source of income. It will also depend on what amount of debt you are carrying.

The average debt excluding mortgages in Edmonton stands at $23,578 as of Q3 2023, with a delinquency rate of 1.72%. This is a year-on-year increase of 21.48% in delinquency rates. However, the average debt has decreased by 2.67%. This disparity could be due to the increase in the working age population in Edmonton due to higher net migration as of 2023, and experts forecast a growing economy. Per capita, the debt has gone down due to the increasing population, but the higher rates of delinquency show that things look very different on an individual level.

DEBT CONSOLIDATION OPTIONS IN EDMONTON, AB

It’s not uncommon for people, including Edmontonians, to fall on hard times. If you’re experiencing difficulty keeping up with your financial obligations, debt consolidation may be your best option to get back on track. As such, consolidating your unsecured debts can make managing your payments easier. For example, multiple credit card debts and other liabilities combine into a single monthly payment. This makes it easier to prepare for and remember when just one due date is approaching every month. In addition, that single payment can be more manageable, with a lower interest rate than the existing rates on your different debts.

While there are different ways to consolidate your debt, the most common way is through procuring a loan. However, your ability to qualify for a consolidation loan depends on your current credit score. Another option is a Home Equity Line of Credit (HELOC). Many Edmonton homeowners are choosing this option. As of Q4 2023, Edmontonians owe $6.43 billion in HELOC debt. They are a great option because interest rates tend to be lower with HELOC, though you do run the risk of losing your home.

OPTIONS FOR A CONSUMER PROPOSAL IN EDMONTON

To file a consumer proposal, Edmonton residents must go through a Licensed Insolvency Trustee in the area. Consumer proposals allow their participants to pay back less than what they owe to their creditors. Despite how good that sounds, it comes with some drawbacks and should be a last resort, much like bankruptcy. To qualify for a consumer proposal in Edmonton, individuals must know to owe more than $250,000. Likewise, a married couple filing jointly cannot have more than $500,000 in debt.

Between 2022 and 203 Edmonton witnessed a 13.2% increase in consumer proposals. Although that’s a big jump, it is less than the Canadian average of 24% over the same time period. In Q1 2024, Albertans filed for 3,966 consumer proposals, which is 6.4 times greater than the number of bankruptcies filed. This follows the pattern of consumer proposals being preferred by most Canadians, as compared to filing for bankruptcy.

Paying less than what you owe at a lower interest rate comes with some heavy consequences. For one, your credit rating will take a significant hit. In addition, the consumer proposal will remain on your credit report up to three years after you complete the five-year program. This can make acquiring credit or buying a home or auto more difficult. However, for Edmontonians struggling to make their full payments, the relief from the financial reset is often worth the drawbacks.

HOW BANKRUPTCY WORKS IN EDMONTON

Many people living in Edmonton are finding it difficult to keep up with the cost of living. If your debts have been piling up to an unmanageable amount, declaring bankruptcy might be the solution to your money troubles. Bankruptcy involves using the services of a Licensed Insolvency trustee to negotiate with creditors to forgive your debt. This allows for a financial reset so people can regain their financial footing. It’s this reset that has attracted Edmontonians to use this option. In 2023, Edmontonians filed 855 consumer bankruptcies equalling just under $145 million. An 18% increase in just one year!

While being debt-free makes Bankruptcy tempting there are some drawbacks to be aware of before moving forward. Declaring bankruptcy gets most of your debts forgiven, however, you forfeit some of your valuable assets in return. Conversely, you may not be able to obtain credit for seven years, and there is a limit on how much you can earn during bankruptcy.

Bankruptcy is a perfectly sound and reasonable path to reset those struggling with debt. However, one must never take bankruptcy lightly, as it is only a last resort. Speaking to a Licensed Insolvency Trustee can shed some light on your options and inform your next steps in finding a fitting solution.

YOU ARE NOT ALONE

On average, Edmontonians have a debt load of $24,911. That’s why many of them reach out to debt.ca each year to finally tackle their debt problems. We helped 82 people in 2025 get their finances, and their life, back on track. With just one phone call to our expert counsellors, we can do the same for you.

Get on the path to debt freedom

Resources available in Edmonton, Alberta for people needing debt relief help

If you are struggling to make ends meet, apart from seeking professional credit help, there are several national, state, local government agencies, along with non-profit organizations, you can turn to:

Edmonton Canada Place Service Canada Centre

9700 Jasper Avenue Edmonton, Alberta

Available Services:

- Unemployment Assistance

- Child Benefits

- Senior Assistance

CRA - Canadian Revenue Agency

9700 Jasper Ave,

Edmonton, AB T5J 4C3,

(800) 959-8281

Edmonton Veterans Affairs

9700 Jasper Avenue

Edmonton, Alberta

1-866-522-2122

Better Business Bureau Of Central & Northern Alberta

16102 100 Ave NW

Edmonton, AB T5P 0L3

(780) 482-2341

Edmonton Food Bank

11508 120 St. NW, Edmonton AB, T5G 2Y2

(780) 425-4190

https://www.edmontonsfoodbank.com/

Alberta Mental Health Patient Advocate Office

10055 106 St NW

Edmonton, AB T5J 2Y2

(780) 422-1812

Salvation Army

9611 102 Ave

Edmonton, Alberta T5H 0E5

(780) 429-4274

Debt Consolidation Loans

Loans Canada

Personal Loan Pro

Consumer Proposal

Melanie Leigh

Licensed Insolvency Trustee

10004 104 Ave NW #1100

Edmonton, AB. T5J0K1

(844) 708-0574

Credit Reports

Additional City Resources in Alberta

Helping residents of Edmonton and the surrounding locations including Leduc, Nisku, Beaumont, St. Albert, Spruce Grove, Story Plain, Sherwood Park, Fort Saskatchewan, Acheson, Camrose and Llyodminster.

Insolvency stats for Edmonton

Insolvency Filings by Quarter - Edmonton

| Quarter | Consumer Proposal | Bankruptcy | Insolvencies |

|---|---|---|---|

| Q4 2025 | |||

| Q3 2025 | 1,340 | 206 | 1,546 |

| Q2 2025 | 1,357 | 244 | 1,601 |

| Q1 2025 | 1,380 | 208 | 1,588 |

| Q4 2024 | 1,349 | 197 | 1,546 |

| Q3 2024 | 1,389 | 233 | 1,622 |

| Q2 2024 | 1,319 | 233 | 1,553 |

| Q1 2024 | 1,313 | 210 | 1,523 |

| Q4 2023 | 1,235 | 197 | 1,432 |

| Q3 2023 | 1,146 | 233 | 1,375 |

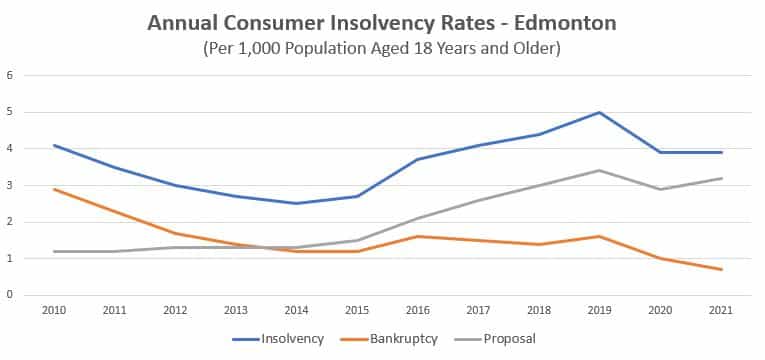

Annual Consumer Insolvency Rates - Edmonton

| '21 | '22 | '23 | '24 | |

|---|---|---|---|---|

| Insolvency | 3.9 | 3.9 | 4.5 | 4.7 |

| Bankruptcy | 0.7 | 0.6 | 0.7 | 0.7 |

| Proposal | 3.2 | 3.3 | 3.8 | 4.0 |

DATA FROM 2024 IN EDMONTON, ALBERTA

| 2024 DATA | |

| POPULATION | 1,544,000 |

| AVERAGE CREDIT SCORE | 645 |

| MEDIAN INCOME | $90,000 |

| AVERAGE HOME PRICE | $420,507 |

| AVERAGE MONTHLY MORTGAGE | $1,535 |

| INSOLVENCY | |

| TOTAL INSOLVENCIES: | 4,766 *(+6.8%) |

| AV ASSETS / INSOLVENCY | $117,813 |

| AV LIABILITIES / INSOLVENCY | $144,438 |

| DEBT RATIO: | 123% |

| BANKRUPTCY | |

| BANKRUPTCIES | 745 *( - 12.2%) |

| AV ASSETS | $76,177 |

| AV LIABILITIES | $172,745 |

| DEBT RATIO: | 227% |

| CONSUMER PROPOSALS | |

| CONSUMER PROPOSALS | 4021 *( +11.3%) |

| AV ASSETS | $125,527 |

| AV LIABILITIES | $139,193 |

| DEBT RATIO: | 111% |

*() change from 2021

Get on the path to debt freedom

About Edmonton

The city of Edmonton began as a small trading post in 1795 and later became the capital of Alberta in 1905. Edmonton was named after a small town in England that resides just north of London. It began to grow as a city when it was named the capital and experienced a massive growth spurt when oil was found nearby. Not only did the oil help the city grow, but it also attracted many new residents, resulting in a population spike.

Notable Edmonton attractions

Over the last 100 years, Edmonton has incorporated various institutions, landmarks and foundations, including:

- The Edmonton Valley Zoo

- University of Alberta

- Ice Palace

- Galaxyland amusement park

- World Waterpark

- The Art Gallery of Alberta

- Fort Edmonton Park

Edmonton’s diverse offerings attract tourists and new residents from all over the world. Known as one of the largest shopping centres in the world, the West Edmonton Mall was the largest mall in the world until the Dubai Mall surpassed it in recent years.

Economic drivers

Today, Edmonton is known to be one of Canada’s largest metropolitan centers. They are heavily involved in oil and natural gas, education, transportation, metal and machinery manufacturing, and environmental engineering industries. Tourism and retail are other major industries.

Recently, Edmonton has performed well economically, contributing to Canada’s overall success as a nation. The unemployment rate in Edmonton is the lowest in Alberta, and the city has produced many new jobs for Canadians. Edmonton works with local, Asian and U.S. markets, which contributes to Alberta’s GDP growth.

Many believe Edmonton is subject to the ebb and flow of the oil industry, but this is not true. Because Edmonton is involved in an array of large industries, the oil industry cycles do not have an immense impact on Edmonton’s economy.

This is important because the city is not impacted by a recession every few years when the oil industry suffers. Edmonton’s other involvements make up for the erratic oil industry behaviour, rise and fall which has proven to be beneficial to Edmonton’s economy.

Alberta 2025 Tax Brackets

Residents of Alberta are required to pay both Federal and Provincial Income Tax each year on your total taxable income.

Each Province sets their own bracket thresholds.

For Alberta:

8% on the portion of your taxable income that is $60,000 or less

+ 10% on the portion of your taxable income between $60,001 and $151,234

+ 12% on the portion of your taxable income between $151,235 and $181,481

+ 13% on the portion of your taxable income between $181,482 and $241,974

+ 14% on the portion of your taxable income between $241,975 and $362,961

+ 15% on the portion of your taxable income that is more than $362,962

Example:

If your total taxable income came out to be exactly $150,000, your provincial tax amount owed would be $13,800.

8% * $60,000 = $4,800 plus

10% * $1,730 ($150,000 - $60,001) = $8,999.90

Provincial tax owed = $4,800 + $8,999.90 = $13,799.90