When I started paying back my $38,000 debt load four years ago, I thought I knew a thing or two about debt.

- I knew that taking on student loans and car loans is considered normal.

- I knew that most Canadians carry debt.

- I knew that paying off my debt would not be an easy feat.

After all, if it were easy, everyone would do it.

Even though I researched it, read personal finance blogs, and made spreadsheets about it, I was still blindsided by these four aspects of paying off debt.

It’s Easier to Pay Off $5,000 than $500

When you are looking your debt in the face, and you know that committing to pay it off might be a multi-year journey, it is incredibly hard to gather up the courage to begin. I danced around the idea of tackling my debt for months before I began paying it back in earnest.

But it doesn’t get easier as you start, either. Once you begin, gaining momentum is a slow process. Not only must you deal with the psychological aspect of starting at the bottom of your debt mountain, but you also have an interest working against you.

When I started, my debt was accumulating $4.10 per day in interest charges. The first $125 of every month went to just paying the interest, before ever touching the principal.

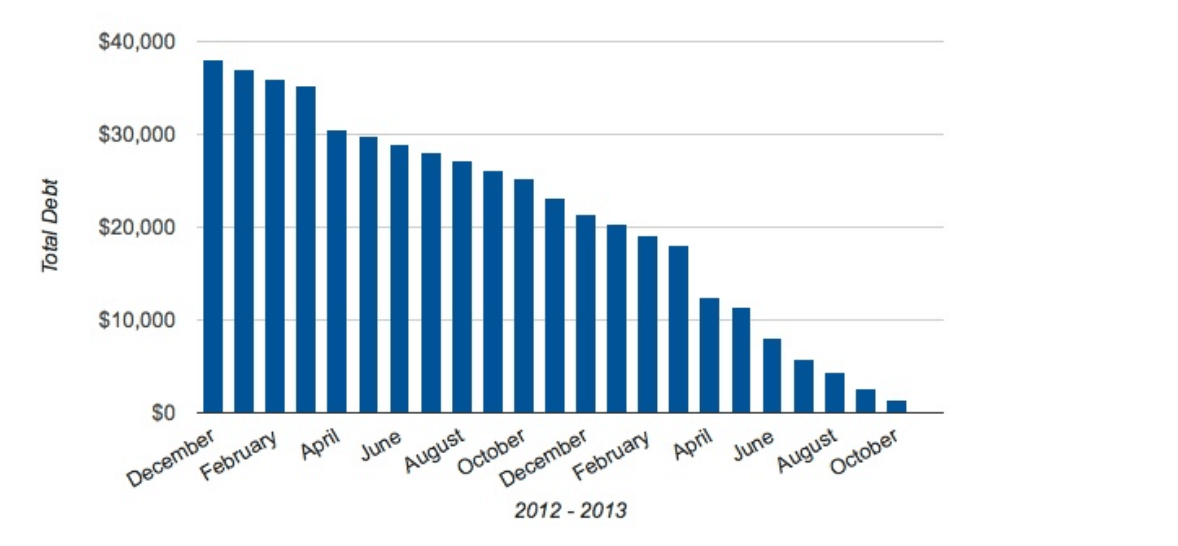

Because of the high interest, it took me seven months to pay off my first $10,000. As my confidence in my debt repaying abilities grew, and I got better at budgeting, I started paying off my debt faster, and the momentum grew.

Here’s a look at my debt repayment progress over time:

If you’re just starting out on your debt repayment journey, and it feels like you are making no progress, stick with it. With persistence, you’ll see results.

Your Friends Won’t Be Happy for You

Picture this. Your friend buys a car or a house and posts a picture of themselves on Facebook. They’re standing in front of their house or car with a “sold” sign. That picture will probably get dozens of likes and comments as all of your Facebook friends congratulate them on their new purchase.

Don’t expect the same thing to happen if you post about paying off debt. Paying off debt, like losing weight or quitting your job to start a business, is not sexy and reminds people of all of their flaws and how they are still carrying debt. Pay off your debt for yourself, not the fanfare, because you won’t get much.

The Game You’re Playing is Rigged

Getting out (and staying out) of debt is next to impossible. It is easy to finance vehicles and homes, swipe your credit card without thinking, and raise your credit limit with the click of a button.

The ease with which we acquire debt is by design. Remember, you are most profitable to lenders when you are up to your eyeballs in debt. Paying off your debt will feel like you are swimming upstream because you are. You are going against the current.

Don’t be surprised when paying off and staying out of debt can feel impossible. Don’t be surprised by the temptation of 0% interest credit cards, unsolicited increases in your credit limit, or warnings that your credit score may decrease when you become debt free.

Remember, when you are in debt, you are profitable to others. When you are debt free, you are profitable to yourself.

Debt Freedom Is Incredibly Anti-Climatic

Whether you’re paying off your first $500, your first $5,000, or your entire debt balance, it never quite feels as exciting as you hope.

When I submitted the last payment on my $38,000 debt two years ago, I was prepared for fireworks. I expected an enormous weight to lift from my shoulders. I expected to have an extra spring in my step. I expected to feel liberated. I thought everyone would understand what I had done, what I had achieved, just by looking at me.

In truth, reaching a milestone in your debt repayment, or paying off your whole debt load is anti-climatic. Nothing is different. You still have the same job, your same responsibilities. The only thing that changes is that you are free from your minimum monthly payments, which means you have several hundred extra dollars every month that you can use to do things that will help your financial future, like:

- Save for a car.

- Or a vacation.

- Or a house.

- Or to go back to school.

Paying off debt is anti-climatic because debt freedom is only the first step on the path to financial prosperity. It’s an important first step, but still a first step.

Paying off debt is many things. It’s empowering and amazing. It’s challenging, rewarding, and oh so necessary. But it’s not all sunshine and rainbows. It’s also difficult to start, can be alienating, and when you finally pay it all off…nothing happens.

But the first time you hold your paycheque and realize that you’re keeping the entire amount without having to pay a single dollar of it to a creditor or lender. That, my friends, is priceless.