The USA has offcially applied tariffs on Canadian-made goods. In response, Canada aaplied retaliatory 25% tariffs on around $155 billion worth of imports from the US.

There’s no doubt that a long lived trade war will mean big economic repercussions. Within a short time there has already been job loss and higher prices for imported goods in the US and Canada. As the trade war goes on, Canadian customers are likely to be negatively affected due to limited alternatives domestically. While this is true for a lot of products. The effects will be especially apparent when it comes to consumer goods.

The upside is that this situation has undoubtedly united many. Canadians now have a strong affinity for buying Canadian-made products and boosting homegrown businesses. Hopefully, this will contribute to strengthening the Canadian economy and encouraging the production and availability of domestic alternatives.

Buying Canadian

The label “Product of Canada” requires at least 98% of the final product to be Canadian. This includes almost all major ingredients, processing, manufacturing, and labour. This label signifies that the product is almost entirely of domestic origin, essentially made in Canada, by Canadians, with low to no imported elements. The term “Canadian” is equivalent to “Product of Canada” for food products. The term “100% Canadian” can only be used when all ingredients, processing and labour are sourced in Canada.

The label “Made in Canada” requires at least 51% of the final product to be Canadian. Products made with imported components must use a qualifying statement such as “Made in Canada with imported parts”. The same rules apply to food products. Take a frozen pizza manufactured in Canada for example. It’s okay to use the “Made in Canada” label, even when using imported cheese, meat, and flour. The only caveat is that it must include a qualifying statement. For example, it would say “Made in Canada with imported ingredients”.

Other qualifying statement examples are: “Packaged in Canada” or “Roasted in Canada”. These qualifying statements indicate the part of the manufacturing process that occurred in Canada. Rules say that all Canadian-made statements require that the last substantial transformation of the product must occur in Canada.

CPI and economic trends

The Consumer Price Index (CPI) reflects changes in average basket cost for typical household goods and services. For example, groceries, utilities, and other general living expenses. Periodic updates to the items included in the “basket” reflect current average consumer spending patterns.

With the anticipated tariffs, prices for imported items will rise. It may even affect inflation rates here in Canada. Domestic alternatives can help mitigate the effects of tariffs. That being said, for some food or food products, buying domestic options may be more expensive. This is because Canada has a smaller production scale and a vast supply chain network to traverse to reach the consumers. In some cases, because of these limiting factors, domestic goods may cost more than US imports.

CPI for food

The CPI (Consumer Price Index) is based on a basket of goods and services that reflect an average Canadian spending pattern. The basket has eight categories – food, shelter, household equipment, clothing, footwear, transport, health and personal care, recreation/education, and alcohol/tobacco/cannabis.

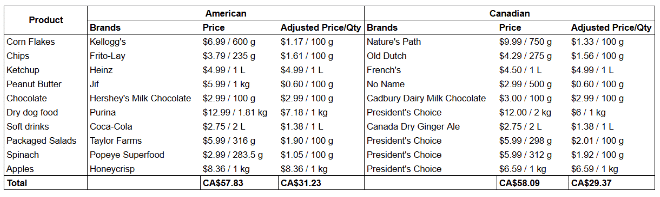

Let’s compare the imported American and domestic Canadian products and prices for some of the food items included in CPI:

Impact on wallet

This chart shows product comparisons based on some foods included in the CPI basket. By dividing the price by weight, we get the price per quantity or unit. Comparing prices alone, Canadian brands, with just a few cents over, cost seems to be at par with American brands. For that overall price, you get more quantity of goods overall, compared to the basket of American brands. This is certainly good news for Canadians! Even for instances where Canadian brands may be priced higher, American goods are likely to cost more if tariffs come into play.

All prices are from the No Frills website as of 18th February 2025. As such, we recognize the limitations of our analysis that come from solely focusing on one store on one date. Even so, we believe, for the purposes of a loose, preliminary analysis, this is reflective enough of an average basket cost at this point.

Research and findings on food products

While looking for information on Canadian-made vs American brands, there were many findings that came as a surprise. It’s difficult to find imported milk, sliced bread and chicken breast. Canadian sources mainly supply those categories. This is good news for Canada’s independent supply in these sectors.

On the other hand, we didn’t find much Canadian produce in terms of fresh fruit and vegetables. Currently, it’s winter, meaning it’s not that much of a surprise it’s difficult to find Canadian produce. We may find more Canadian produce in stores when the growing season starts up again. Imported produce includes; tomatoes, onions, potatoes, melons, and apples. This means we are highly dependent on imports even for staple foods. Not good news for the end consumer if the tariffs are imposed.

Interestingly, often a Canadian-made label is missing from the apples, cranberries, and blueberries we’ve grown in Canada. Most of our homegrown cranberries are exported. We also found that many of our homegrown apples are exported to be turned into cider, baked goods, and more. We likely have other domestic food items being exported instead of sold in Canada. Only time will tell how tariffs will affect these structures, supply chains, and sale choices.

Products “Prepared in Canada” and our findings

All the “Prepared in Canada” foods we found brought up an important point to share. We’ll use tomatoes as an example. While tomatoes themselves are imported to Canada, we found quite a few “Prepared in Canada” canned tomatoes, stewed tomatoes, diced tomatoes, and other tomato products. This means that the tomatoes are imported, with processing, preparation, and packaging done in Canada.

If the tariffs hit, these kinds of products will still be subject to tariffs by way of these imported products. They would likely have to pay tariffs to bring tomatoes into the country, for example. This means the cost of the raw materials for those products labelled as “Prepared in Canada” will go up. So, even if we don’t pay tariffs directly on such products, we will indirectly. At some point in the supply chain, costs will be higher and the increase will likely be passed on to us as end consumers.

Practical tips

- Check labels: Keep an eye on labels before making purchasing decisions. Make note of domestically produced goods. For those that aren’t, see if you can find an alternative. This is an opportunity for Canadians to make an impact by way of where they choose to spend their dollars. Supporting domestic businesses helps ensure support of local industries, and helps the consumer avoid imported goods with higher tariffs as far as possible.

- Compare prices: From our chart above, we can see that domestic vs imported products don’t vary drastically in price. Even if the Canadian products are more expensive, see whether paying a little more for Canadian-made goods can help save more overall. Compare the sticker prices, but also consider the higher cost of imported US goods after tariffs are applied. It may turn out that after adding the high tariff cost, the imported products end up costing more than the domestic option. If so, you’ll also be saving more by buying domestic goods.

- Support local businesses: As much as you can, choose farmers’ markets and Canadian brands over imported goods. How and where Canadians choose to spend can greatly impact how we will handle the cost of tariffs as a whole, all while supporting homegrown industries and reducing reliance on imports.

- Resources and community: Stay up to date on information about Canadian brands via online resources. Websites like madeinca.ca provide comprehensive information about Canadian companies that you can choose to buy from. There are many groups and communities on social media where people share information about Canadian brands, large and small. A community can also help fact-check whether the information you find is accurate, and is a valuable resource when you’re trying to make a real difference by doing the right thing.

Key takeaways

Buying Canadian-made goods helps domestic industries, which in turn supports local economic resilience. Making these changes to your regular shopping choices can contribute to this benefit. As much as you can, try to support smaller local businesses. Buying domestic goods may not be able to entirely offset the financial impact of tariffs. Sometimes domestic goods cost more than imported products and are sometimes made with imported ingredients. If you’re on a tight budget, buying Canadian-made may be a little difficult to implement, especially if the price difference is large. Do what you can to support Canadian businesses, but don’t go beyond your budget. Put your finances first. If you’re currently dealing with debt, you can contact one of our trained credit counsellors for advice.