Debt Relief Solutions in Charlottetown, PEI

Residents of Charlottetown, Prince Edward Island have reduced their payments by up to 50% by contacting Debt.ca for help.

Debt.ca will evaluate your situation and refer you to qualified and vetted professionals based on the solution that will work best for you.

Reduce Your Payments By Up To 50%

Lower Your Interest Rates

Make One Low Monthly Payment For All Your Debt

Debt Free in as little as 24 – 48 Months

Canadian Debt Relief

Credit Counselling

Debt Management Plans

Debt Consolidation

Consumer Proposal

Bankruptcy

Not Alone

Debt.ca is Canada’s trusted source for debt relief

At Debt.ca, we understand that people might find themselves surrounded with debt for many reasons including job loss, reduced income, medical expenses, or even the rising costs of raising a family. And when faced with a mountain of consumer debt, it is quite easy to become overwhelmed and to believe that you will never be able to pay off your creditors. The high-interest rates associated with consumer debts, late fees for those who are behind on their payments, and much more can seem to conspire against your attempts to become debt free. That is why we want to help all Canadians better understand their debt relief options and save the most money while they get out from under their unsecured loans.

Are you struggling with debt or trying to figure out which Canadian debt relief program will help you get out of debt in the quickest amount of time and for the least amount of money? If so, let us show you that you can live a life free of bills and you do have more options than you probably realize. Simply put, if your paying out more money every month than you have coming in, we can get you to a professional who can help. Fill out the form above to get started today!

CREDIT COUNSELLING HELP IN CHARLOTTETOWN, PEI

Debt.ca has credit counselling services in Charlottetown for families looking to improve their finances. As the capital of Prince Edward Island, Charlottetown sits on the southern coast of the province. The city has an array of places to stay, things to do, and foods to taste. With so much to offer, it's easy to overspend here. With a low average median income and relatively high unemployment rate, many people find themselves in debt here. The key to getting out of debt is to seek and gather knowledge.

If you live in Charlottetown and feel like your finances are out of control, then credit counselling may be the debt solution you are looking for. Locals can get credit counselling services in Charlottetown, or learn about the other options Debt.ca has to offer. If you're serious about getting out of debt, we can help.

WOULD A DMP WORK FOR RESIDENTS OF CHARLOTTETOWN, PEI?

Residents of Charlottetown often confuse debt management plans with credit consolidation, because they have some similarities. For instance, both programs entail converting several debts into one monthly payment for ease of tracking. However, you still owe the original creditors when you enroll in a debt management plan (DMP). Conversely, you only owe one entity when you participate in a debt consolidation loan. If you’re considering a DMP in Charlottetown you must have a steady source of income.

While DMPs serve those with more than $10,000 of debt, homeowners may have to cash out equity instead. Likewise, individuals who have funds in their RRSP may have to use those funds to pay off the debt in lieu of enrolling in a debt management plan. Speak to a counsellor in Charlottetown to determine if a DMP is the right option for you.

DEBT CONSOLIDATION OPTIONS IN CHARLOTTETOWN, PEI

As a citizen living in Charlottetown, it’s not uncommon to fall on hard times. If you’re experiencing difficulty keeping up with your financial obligations, debt consolidation may be your best option to get back on track. As such, consolidating your unsecured debts can make managing your payments easier. For example, multiple credit card debts and other liabilities combine into a single monthly payment. This makes it easier to prepare for and remember when just one due date is approaching every month. In addition, that single payment can be more manageable, with a lower interest rate than the existing rates on your different debts.

While there are different ways to consolidate your debt, the most common way is through procuring a loan. However, your ability to qualify for a consolidation loan depends on your current credit score. Learn more about the debt consolidation process in Charlottetown here.

OPTIONS FOR A CONSUMER PROPOSAL IN CHARLOTTETOWN, PEI

To file a consumer proposal, Charlottetown residents must go through a Licensed Insolvency Trustee in the area. Consumer proposals allow their participants to pay back less than what they owe to their creditors. Despite how good that sounds, it comes with some drawbacks and should be a last resort, much like bankruptcy. To qualify for a consumer proposal in Charlottetown individuals must know to owe more than $250,000. Likewise, a married couple filing jointly cannot have more than $500,000 in debt.

Paying less than what you owe at a lower interest rate comes with some heavy consequences. For one, your credit score drops to the absolute lowest it can go. In addition, the consumer proposal will remain on your credit report up to three years after you complete the five-year program. This can make acquiring credit or buying a home or auto more difficult. Speak to a member of our team who understands the laws regarding consumer proposals in Charlottetown today.

HOW BANKRUPTCY WORKS IN CHARLOTTETOWN

Many people living in Charlottetown can find it difficult to keep up with the cost of living. If your debts have been piling up to an unmanageable amount, declaring bankruptcy might be the solution to your money troubles. However, one must never take bankruptcy lightly, as it is only a last resort. Speaking to a Licensed Insolvency Trustee can shed some light on your options and inform your next steps in finding a fitting solution.

Remember, declaring bankruptcy gets most of your debts forgiven, however you forfeit most of your valuable assets in return. In addition, you will no longer experience wage garnishments. Conversely, you may not be able to obtain credit for seven years, and there is a limit on how much you can earn during bankruptcy. If you’re thinking about filing for bankruptcy in Charlottetown call us to speak with a professional who can help.

YOU ARE NOT ALONE

In 2025, 2 Charlottetown residents reached out to debt.ca to finally tackle their debt problems. They were struggling with an average debt load of $4,627 but now have the help they need to get their finances, and their life, back on track.

Get on the path to debt freedom

Resources available in Charlottetown, PEI for people needing debt relief help

If you are struggling to make ends meet, apart from seeking professional credit help, there are several national, state, local government agencies, along with non-profit organizations, you can turn to:

Charlottetown Service Canada Centre

Jean Canfield Building, Floor Main

191 Great George Street

Charlottetown, Prince Edward Island

Available Services:

- Unemployment Assistance

- Child Benefits

- Senior Assistance

CRA - Canadian Revenue Agency

CRA - Revenue Agency

30 Brackley Point Rd Suite 1, Charlottetown, PE C1A 6X9

(800) 959-8281

Veterans Affairs Canada

191 Great George St,

Charlottetown, PE C1A 4L2

(866) 522-2122

Upper Room Hospitality Ministry

101 Richmond St

Charlottetown, PE C1A 1H7

(902) 892-1995

Optimum Health Counseling

185 St Peters Rd

Charlottetown, PE C1A 5P6

(902) 626-6929

Salvation Army

203 Fitzroy St,

Charlottetown, PE C1A 1S1

(902) 892-2281

Debt Consolidation Loans

Loans Canada

Debt Relief Loans

Helping residents of Charlottetown and the surrounding locations: Cornwall, Stratford, Marshfield, Alexandria, Highfield, Montague, Royalty Junction.

Insolvency stats for Charlottetown

DATA FROM 2022 IN CHARLOTTETOWN, PRINCE EDWARD ISLAND

| 2022 DATA | |

| POPULATION | 40,500 |

| AVERAGE CREDIT SCORE | 636 |

| MEDIAN INCOME | $66,000 |

| AVERAGE HOME PRICE | $382,880 |

| UNEMPLOYMENT RATE | 7.2% |

| INSOLVENCY | |

| TOTAL INSOLVENCIES: | 443 *(+15.7%) |

| AV ASSETS / INSOLVENCY | $51,568 |

| AV LIABILITIES / INSOLVENCY | $78,819 |

| DEBT RATIO: | 153% (- 3%) |

| BANKRUPTCY | |

| BANKRUPTCIES | 169 *(+0.6%) |

| AV ASSETS | $23,902 |

| AV LIABILITIES | $69,387 |

| DEBT RATIO: | 290% |

| CONSUMER PROPOSALS | |

| CONSUMER PROPOSALS | 274 *(+27.4%) |

| AV ASSETS | $68,632 |

| AV LIABILITIES | $84,637 |

| DEBT RATIO: | 123% |

Source: https://www.ic.gc.ca/

*() change from 2021

Insolvency stats are for Prince Edward Island

Get on the path to debt freedom

About Charlottetown

WHAT IS UNIQUE ABOUT CHARLOTTETOWN

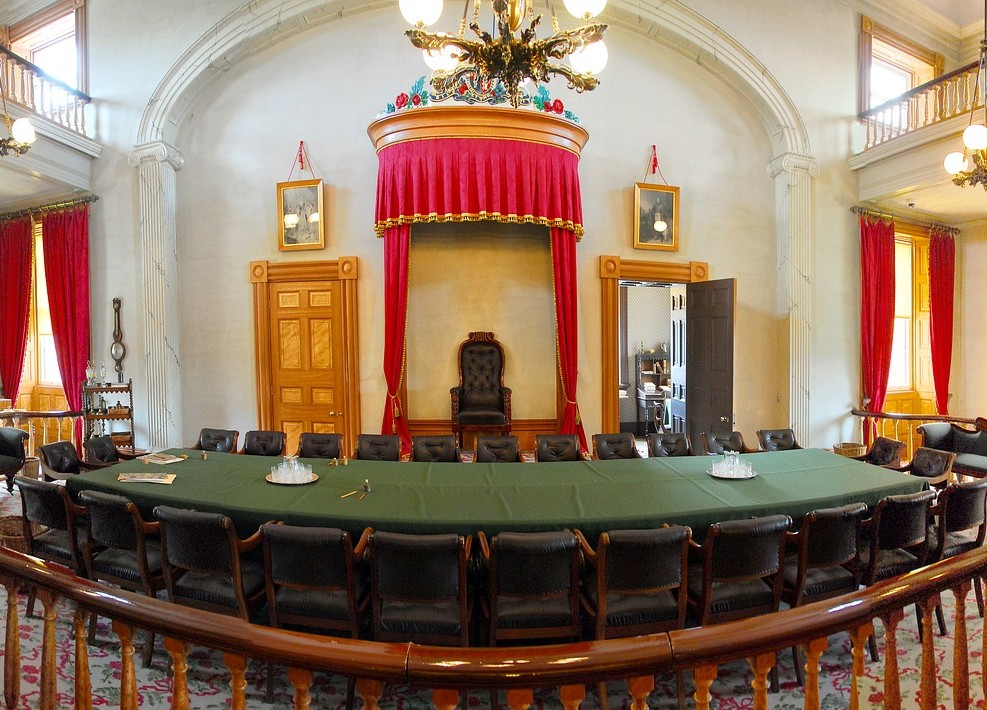

Charlottetown is the capital of the province of PEI, located on the southern coast. As the largest city, the population of Charlottetown is 36,094. That's almost half of the people in the whole province. The Northumberland Strait separates it from the mainland. The Charlottetown Conference happened in 1864, which led to the Confederation, and the idea of Canada. Charlottetown is a small city full of culture, which attracts many people from all over.

CHARLOTTETOWN'S HISTORY

The French were the first European settlers in 1720, but the British took over after eliminating any French settlers they could find. Known initially as Port la Joie, the town got its name from Queen Charlotte, wife of King George III. By 1855, Charlottetown became a city. Its population was 6,500 at the time. In 1874, the Prince Edward Island Railway opened, which ran between Charlottetown and Summerside. The industry brought about more prosperity, and the city grew more when the village of Spring Park joined in 1959. In the 1970s and 1980s, there was a lot of commercial and retail growth. By the 1990s and 2000s, retail was a big business in the city.

WHAT’S CHARLOTTETOWN FAMOUS FOR?

Charlottetown is known for its friendly people and beautiful landscape. It has white sand beaches and excellent golf courses. The warm waters and unique architecture make downtown Charlottetown a popular place for tourists to visit. The city is considered the Cultural Capital of Canada, with many small theatres and art galleries serving as entertainment venues and attractions. Many arts programs and performances take place in Charlottetown.

Theatres and galleries in the city include:

- Confederation Centre of the Arts

- MacKenzie Theatre

- Arts Guild

- Pilar Shepard gallery

What are the Large Economic Drivers?

The public sector is crucial in terms of Charlottetown's employment offerings. Provincial, federal, and municipal government offices are big employers. The health care, education, and manufacturing sectors are also outstanding for their job offerings to residents.

Farms and technology companies that call Charlottetown home comprise much of the city's economy.

Other important industries in the province include:

- Fisheries

- Tourism

- Aerospace

- IT

- Renewable energy

RECENT CHANGES THAT MAY HAVE CHANGED THE ECONOMIC OUTLOOK

The biotechnology industry has grown in Charlottetown and contributes many jobs to the benefit of the city. There is also a lot of investment in the private sector, with many downtown properties undergoing renovations. Increased office space and a cruise ship terminal also opening in 2007 can help make Charlottetown a more accessible destination for ships in the Gulf of St. Lawrence.