At a time when prices continue to go through the roof, any reduction in income is a dreaded scenario. Luckily, the government of Canada’s tax laws allow for income replacement provisions. This happens by way of benefits Canadians pay for while earning and reap when the earnings stop or pause. Two such benefits are the Canada Pension Plan (CPP) and Employment Insurance (EI) benefits.

With effect from 2024, the federal government has increased the contribution amounts in both these programs, which means some of you have probably seen a reduction in your take-home salary. Read on to know more.

The basics

CPP and EI are deducted from the employee’s payroll and an amount towards the same is contributed by the employer as well. Self-employed individuals must contribute the full amount (employer and employee portions). The money contributed is managed by the CPP Investment Board (CPPIB)

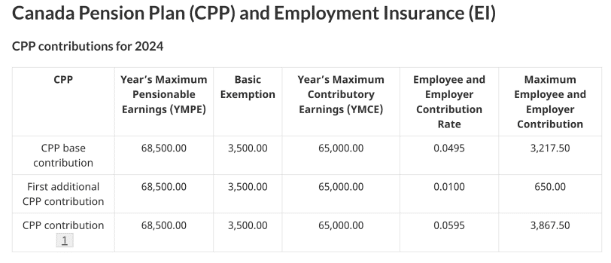

With effect from 2024, there is a change in the income bracket on which CPP contributions are calculated and in the EI premium rate as well. The minimum income on which CPP contribution is mandatory is $3500. The maximum pensionable earnings was $66,600. The current rate of contribution stands at 5.95 percent.

The CPP calculator works like this – one must minus the basic exemption limit of $3500 from the income they earn and multiply the difference by 5.95 percent. If you earn more than $66,600, the additional income is not subject to CPP contribution. Hence the maximum CPP contribution by an employee would be $3,754.56 annually.

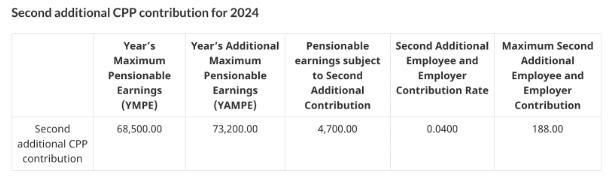

However, with effect from 2024, the maximum pensionable earning limit has been enhanced from $66,600 to $68,500. What’s more, anyone earning more than $68,500 will have to make a second-tier contribution that caps at $73,200 and is charged at a rate of 4 percent.

The impact

CPP

This means that the overall maximum pension contribution for those earning more than $73,200 will increase by $300 annually. Individuals earning less than $66,600, i.e. the earlier cap, won’t see any changes.

To understand the math better, review the table below.

Source: https://www.canada.ca/en/revenue-agency/services/forms-publications/payroll/t4032-payroll-deductions-tables/t4032on-jan/t4032on-january-general-information.html#_Toc337712807

While the additional contribution might pinch a few pockets, it will increase post-retirement benefits or CPP survivor benefits. This CPP enhancement increases retirement income from one-quarter of their eligible income to one-third of their eligible income.

EI

Employment Insurance premium rates hiked from $1.63 to $1.66 per $100 of insurable earnings for individuals. The maximum annual insurable earnings rose from $61,500 to $63,200. This means the 2024 EI contribution by employees earning more than $63,200 will increase by $46.67.

However, again, one must note that the contribution paid now will pay off as a benefit when one is unemployed and looking for employment or has taken time off to upgrade their skills. The EI program also provides special benefits to workers who take time off work due to specific life events:

- illness

- pregnancy

- caring for a newborn or newly adopted child

- caring for a critically ill or injured person

- caring for a family member who is seriously ill with a significant risk of death

Applying for CPP/EI

First, you must ensure you’re eligible to receive CPP benefits or EI. For CPP there are age requirements. You must have completed at least 60 years of age. However, CPP is not reserved only for when you attain retirement age. The Canada Pension Plan (CPP) disability benefit is a monthly payment you can get if you are unable to work because of a disability, as long as you’ve contributed to the CPP. In the case of EI, you must ensure you apply for it as soon as you stop working. If you delay filing your claim for benefits for more than 4 weeks after your last day of work, you may lose benefits. A Service Canada representative will determine your eligibility post which you can start receiving your CPP retirement pension or EI.

Final thoughts

Canada’s consumer price index or inflation has been on the rise. While the additional deductions from the income may squeeze budgets right now, Canadians can seek security in the fact that these contributions will enhance their retirement savings, provide OAS and at least partly replace any income loss that may happen due to circumstances beyond their control.