If you’re looking for information on Ontario consumer proposal statistics, Debt.ca has a wide range of data available. The number of those who had to file the proposal was 2,455 in August 2022. This is up 36% from 1,808 in comparison to August 2021.

Back in March of 2013, the rate of consumer price inflation (CPI) was low by historical standards, as prices grew at an average of only 1.2% from the same period in 2012. We’ve seen many changes since then. In Sep 2022, Statistics Canada says that CPI hit 6.9%.

A modest increase in prices can spell trouble for those who are already having difficulty paying their bills on time. According to Statistics Canada, the average Canadian household had total non-mortgage debts of $49,937 in Q2 2022. A rise in consumer prices means that many debtors will be adding more to their debt.

If you live in Ontario and are having trouble paying your consumer debt, there is help for you. This includes debt solutions such as the Canadian consumer proposal. Ontario residents who want to be debt-free should definitely consider this method of debt repayment.

Insolvency & Consumer Proposal Statistics in Ontario

An Overview of the Ontario Consumer Proposal

The consumer proposal is a debt solution that provides all of the essential protections of bankruptcy without the associated fees and time in bankruptcy court. In a consumer proposal, residents work with a licensed insolvency trustee to formulate a legal proposal to lower interest rates and settle debts for less than what they owe. After all, it is a legal process.

Once a consumer proposal in Ontario has been put together, it is sent to one’s unsecured creditors for approval. The proposal is binding on all creditors if creditors holding a simple majority of their debt — 51 percent accept the proposal.

A consumer proposal is for those who have a high level of debt and an insufficient amount of assets to have a reasonable chance of paying it off. If you owe up to $250,000 in consumer debt, you will likely qualify for a consumer proposal, although other options will probably be better if you owe less than $10,000. Married couples can have up to $500,000 in debt when filing jointly.

What Are the Advantages and Disadvantages of an Ontario Consumer Proposal?

In addition to giving residents with a high level of consumer debt an easier way to pay off debt, there are other advantages of the consumer proposal. Ontario consumers also benefit from:

• Convenience— A consumer proposal consolidates debt and you pay it off through the insolvency trustee in one lump-sum payment or in a monthly payment plan.

• Asset Protection— A consumer proposal protects your assets from seizure and stops the calls from bill collectors.

However, there are also disadvantages to a consumer proposal in Ontario, such as:

• Future Credit— Though it is not a bankruptcy, a consumer proposal impacts your credit score like bankruptcy. In other words, it will be hard for you to get new credit. Your credit report reflects your consumer proposal for a period of three years after you complete it.

• Changing Terms— If you miss 3 payments, your legally binding proposal will automatically be annulled. This won’t happen as often in another debt solution such as debt settlement.

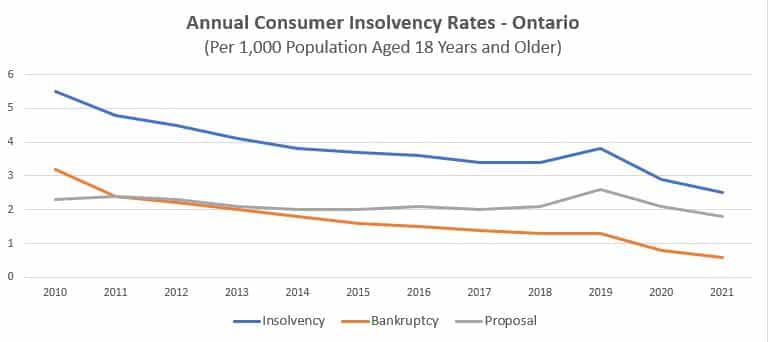

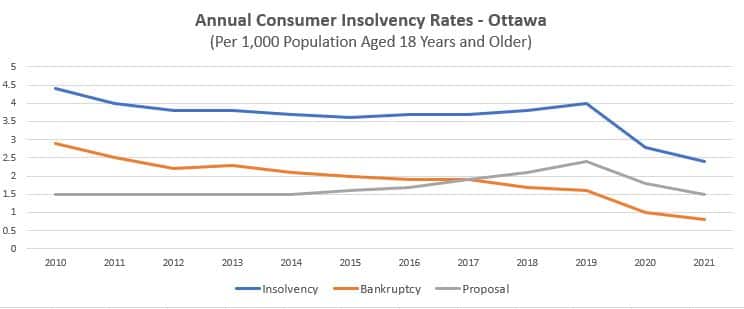

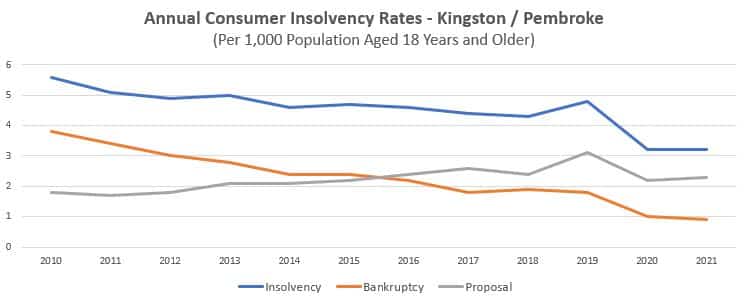

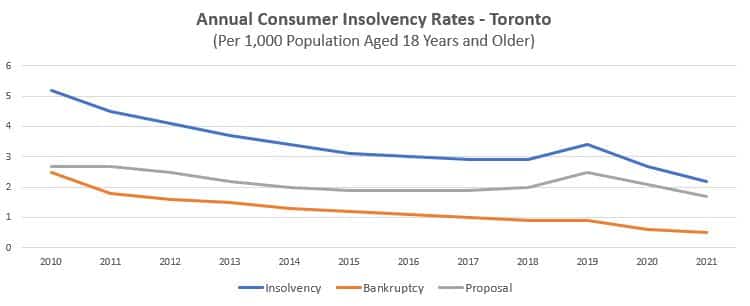

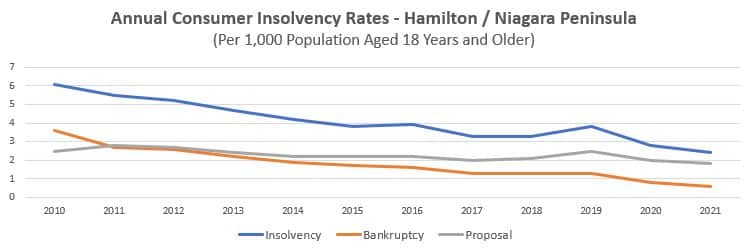

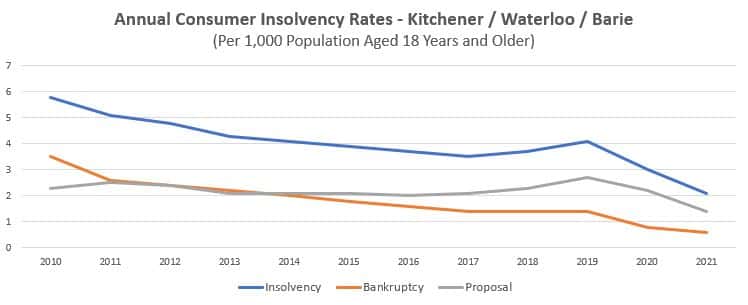

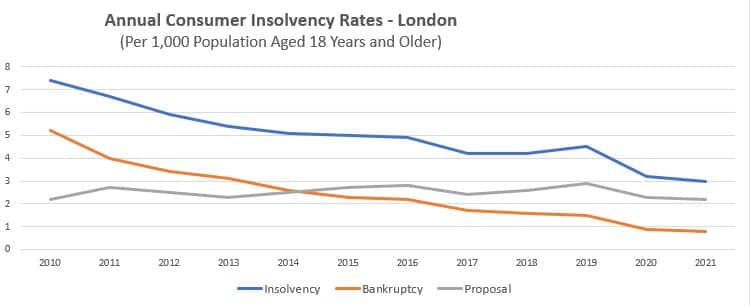

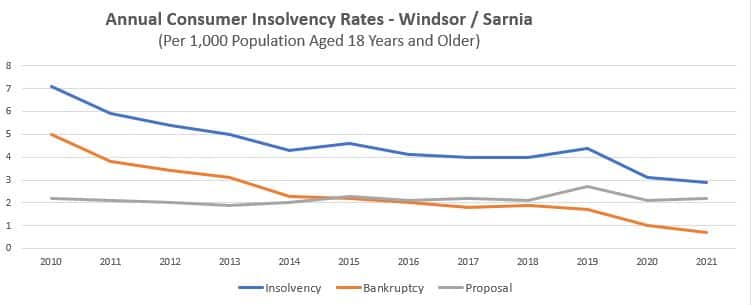

Annual Consumer Insolvency Rates across Ontario

Source: https://www.ic.gc.ca/

Find Out More

To find which debt relief solution is most appropriate for your financial situation, fill out the online debt relief form and receive an accurate estimate of your savings with the various debt relief options.

Looking for consumer proposal resources in Ontario: