In Canada, doing a consumer proposal falls under the purview of the Bankruptcy and Insolvency Act of 1985. It allows you to propose a settlement to your creditors for less than the actual amount owed. While you will still owe a certain amount, a large part of your debt is likely to be forgiven.

As soon as you file the proposal, your debt will not continue to accumulate any interest – at least until the creditors accept or reject your proposal. As long as your proposal has been well thought out, chances of approval are high.

A consumer proposal allows you to consolidate all your dues into a single payment. Once your proposal is approved, you can pay it off either as a lump sum or in monthly installments.

What is a consumer proposal?

A consumer proposal is a debt settlement arrangement and an alternative to filing for bankruptcy in Canada. It is filed through a Licensed Insolvency Trustee (LIT) who negotiates with creditors on your behalf. It is a legally binding agreement, and applicants pay less debt than initially owed by 70 or 80 percent. In addition, you’re showing your commitment to making payments on time. You can keep most of your assets while making payments towards your debt when you opt for a consumer proposal.

To file a consumer proposal, you need to have at least $1,000 in unsecured debt. The maximum amount you can qualify for is $250,000. However, a married couple filing jointly can carry a maximum debt of $500,000.

How does a consumer proposal work?

A consumer proposal is a legally binding agreement between you and all the creditors you owe money to, wherein you agree to pay back part of what you owe, and the rest is forgiven. However, It only covers unsecured debt.

Your trustee will help you prepare the proposal. Once you file the consumer proposal (with the help of a Licensed Insolvency Trustee), your creditors take a vote and decide whether they want to accept or reject your proposal. A majority of creditors need to vote to accept – if they do, the agreement is accepted and legally binding to all creditors. In essence, creditors who hold more than 51% of the total value of your debt have the qualifying vote, and the rest will be legally required to abide by the final decision.

The increasing appeal of a consumer proposal

There has been an increase in consumer proposals over the past few years. This is directly related to the changes in the Bankruptcy and Insolvency Act, or BIA, in 2009.

The changes were related to the debt limit for a consumer proposal. The maximum limit was changed from $75,000 to $250,000. This is a substantial increase and was a much better alternative for many who would have been forced to file for bankruptcy instead. In addition, the Act also specified that financial counselling was mandatory for debtors whose proposals were approved.

These changes made it much easier for a much greater range of debtors to file – and be approved for – a consumer proposal.

Consumer Insolvency & Consumer Proposal Statistics in Canada

| Nationwide | ||||

|---|---|---|---|---|

| 2022 | 2021 | 2020 | 2019 | |

| Insolvency | 100,184 | 90,092 | 96,458 | 137,178 |

| Consumer Proposal | 75,598 | 62,631 | 63,578 | 82,769 |

| Alberta | ||||

| Insolvency | 14,875 | 13,956 | 13,089 | 16,675 |

| Consumer Proposal | 12,501 | 11,225 | 9,487 | 11,086 |

| British Columbia | ||||

| Insolvency | 10,167 | 8,699 | 8,270 | 11,221 |

| Consumer Proposal | 8,346 | 6,527 | 5,661 | 7,087 |

| Manitoba | ||||

| Insolvency | 2,773 | 2,507 | 2,527 | 3,146 |

| Consumer Proposal | 2,039 | 1,725 | 1,740 | 1,802 |

| Newfoundland & Labrador | ||||

| Insolvency | 1,928 | 1,737 | 1,873 | 3,221 |

| Consumer Proposal | 1,254 | 1,095 | 1,105 | 1,755 |

| New Brunswick | ||||

| Insolvency | 3,128 | 2,985 | 3,365 | 4,851 |

| Consumer Proposal | 2,101 | 1,744 | 1,879 | 2,508 |

| Nova Scotia | ||||

| Insolvency | 3,467 | 3,007 | 3,498 | 6,040 |

| Consumer Proposal | 2,259 | 1,739 | 1,889 | 2,847 |

| Northwest Territories | ||||

| Insolvency | 56 | 53 | 47 | 66 |

| Consumer Proposal | 53 | 44 | 37 | 57 |

| Nunavut | ||||

| Insolvency | 13 | 12 | 12 | 6 |

| Consumer Proposal | 13 | 11 | 12 | 6 |

| Ontario | ||||

| Insolvency | 34,736 | 30,327 | 33,992 | 44,852 |

| Consumer Proposal | 27,603 | 22,747 | 24,779 | 30,275 |

| Quebec | ||||

| Insolvency | 25,433 | 23,667 | 26,683 | 42,865 |

| Consumer Proposal | 16,638 | 13,554 | 14,969 | 22,827 |

| Prince Edward Island | ||||

| Insolvency | 443 | 384 | 426 | 749 |

| Consumer Proposal | 274 | 215 | 223 | 363 |

| Saskatchewan | ||||

| Insolvency | 3,116 | 2,724 | 2,640 | 3,453 |

| Consumer Proposal | 2,724 | 1,980 | 1,762 | 2,136 |

| Yukon | ||||

| Insolvency | 49 | 34 | 36 | 33 |

| Consumer Proposal | 43 | 25 | 25 | 20 |

Source: https://www.ic.gc.ca/

A consumer proposal’s effects on your credit

A consumer proposal is hardly ever a first choice for someone looking to repay their debts. This is due to the drastic effect it has on your credit score – though not as bad as it would be if you’d filed for bankruptcy instead.

Effects on credit after approval

Following a proposal, you will receive an R7 rating on your credit report.

A consumer proposal will stay on your credit report for 3 years after you’ve fully paid it back. Generally, This means that if you pay off your proposal in 3 years, it stays on your credit report for a total of 6 years.

Duration of effect on your credit score

Your ability to apply for any sort of loan, borrowing or financing will be affected for 3 years at the minimum. While not impossible to get new credit, you will likely have a tough time getting it and your interest rates are likely to be sky-high if you do.

It is advisable to refrain from borrowing any more money while in the process of paying back a proposal.

How to rebuild your credit after a consumer proposal

The key is consistency. Making payments regularly and on time can improve your credit rating. You need to make sure you do not miss a single payment, however small. A missed payment can quickly impact your credit rating.

Keep an eye on your credit report, and follow your budget. Basically, the goal is to show creditors that you are dependable, trustworthy, and committed to paying your bills on time.

How much does a consumer proposal cost?

A Licensed Insolvency Trustee will help you come up with a proposal for your creditors. Since each proposal is tailor-made, there’s no “one size fits all” template. The key is to put together a proposal that is beneficial for you and the creditors. The Insolvency Trustee will help you with that.

In your proposal, there will be an offer to pay creditors a portion of the total debt you owe them, a time period extension to help you repay the sum or both. Generally, among other factors, this will depend on your debt amount and existing financial situation.

Note: A consumer proposal cannot go beyond 5 years.

A Licensed Insolvency Trustee will help you structure your proposal in a way that your creditors are likely to accept, thus increasing your chances of approval.

How can you qualify for a consumer proposal?

A consumer proposal, once accepted, is legally binding to all your creditors. If accepted by the majority of your creditors need to agree to the terms you are bound to the terms. For example, some creditors may refuse to accept your proposal. If they hold 49% or less of the total amount of debt, they will still have to abide by the decision of the 51% (i.e. the majority holders). If the creditors who hold 51% of your debt agree to the provisions of the proposal, the rest will be forced to accept.

Financial conditions

Your unsecured debt must be between $1,000 to $250,000. However, for a married couple filing jointly, this increases to $500,000. This does not include secured loans, like mortgages or vehicle loans. It also does not count existing assets.

Creditor Approval – Vote to Accept or Refuse

Creditors prefer a consumer proposal to a bankruptcy claim, as they get back more of the money owed. However, other debt solutions like credit counselling or debt consolidation provide more of the owed amount to creditors. Basically, you want to show that you’ve already tried other debt solutions without success.

If they can see that you genuinely did put in the effort, and this is the best you can do, they are likely to accept. They know that the only option left otherwise would be bankruptcy, and they would prefer the option that pays them more of their money back.

What happens when the consumer proposal is accepted?

Once your proposal is accepted by creditors, it means that the proposal is now court-approved and legally binding. You must now abide by the terms of your proposal. Including, making your monthly payments regularly and on time, as well as, attending two mandatory credit counselling sessions.

What happens when the consumer proposal is rejected?

If your proposal is rejected, it means that 51% or more of your creditors have chosen not to accept your proposal. The “stay of proceedings” does not continue to apply once the proposal has been rejected, and interest starts being applied again. Consequently, creditors can choose any means they see fit to try and recover the full amount from you.

How do you file a consumer proposal?

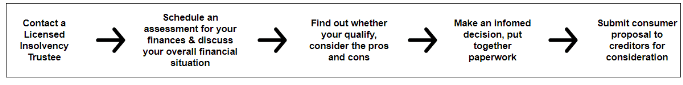

You have to work with a Licensed Insolvency Trustee to put together a consumer proposal that creditors are likely to accept. Your first step is to contact a licensed trustee to schedule an assessment of your finances.

This assessment helps the trustee understand your overall financial situation. That’s why it is important that you answer all questions honestly and accurately. You must provide information to the best of your knowledge and make sure they have a comprehensive picture of your finances.

Once the trustee has information and clarity, they will determine whether you qualify for a consumer proposal. If you do, you must understand the advantages and disadvantages of a consumer proposal and compare them with other debt-relief options like debt settlement or debt consolidation.

The trustee may also make a recommendation on what debt relief option you might be suited for. Make an informed decision on whether this is the right fit for you and your finances, then go ahead with the final decision. Once you do, it is time for paperwork and documentation, which your licensed trustee will help you put together.

Advantages of a consumer proposal

Reduce unsecured debt

Your minimum monthly payments are lowered, often drastically. No additional interest charges are levied. Many creditors are also often willing to forgive part of your debt, which will speed up your timeline towards being debt-free.

In addition, you no longer accrue interest on all the debt covered within the proposal.

Asset protection

Your existing assets like your home, car, and wages or salaries are protected. Creditors will not be allowed to seize your assets or even make an attempt to do so. They will also not be allowed to garnish your wages. Depending on your province, your RRSPs, pensions, and life insurance policies may also remain untouched.

This is a big benefit of a consumer proposal over bankruptcy, as creditors can no longer lay claim to assets like large household purchases, cars, or even jewellery.

More peace of mind

Once the proposal has been accepted, collection agencies will not be allowed to contact you. The mental strain of being repeatedly contacted, and often harassed, by collection agencies is no light discomfort. Instead of dealing with this level of pressure, you will have more attention to devote to building your finances in a healthy way.

With a consumer proposal, you can also continue to sponsor family members abroad.

Less damaging alternative to bankruptcy

With a consumer proposal, your existing assets and employment income are protected. They cannot lay claim to any of it, or even garnish wages. It also has comparatively shorter-lived effects on your credit score as compared to bankruptcy.

Addresses your debts to CRA

You can include debts you owe the CRA in the consumer proposal, like income tax, source deductions, and more. CRA abides by the rules of a proposal same as any other creditor.

Disadvantages of a consumer proposal

Effects on credit rating

A consumer proposal negatively affects your credit score, though not to the extent that bankruptcy does. You will get an R7 rating on your credit report. It will also affect your ability to apply for a loan or financing, for at least 3 years.

No coverage for secured debt

A consumer proposal does not cover secured debt, such as a mortgage or car payments, a consumer proposal won’t help. A consumer proposal only covers various types of unsecured debt.

If you have an existing mortgage or auto loan that is not financially viable anymore, you may not want to continue. In such cases, you can allow the creditor to take over the possession of your asset when your proposal starts. Your shortfall – which is the difference between what you owe the creditor, and how much they can recover from the sale of your asset – can then be added to your consumer proposal and written off.

Public record

Consumer proposals are a matter of public record. Consequently, if anyone wishes to check your credit, they will find this information easily. If this is something that factors into your decision-making, consider whether a consumer proposal is right for you.

After a few years, however, it will no longer show up on your credit report. After that, while it still remains on record, it takes much more effort and expense to find it. At this point, it has very little chance of affecting any significant life decisions or changes.

Consumer proposal repayment plan and process

If you have decided to go ahead with a consumer proposal, the first step is to reach out to a Licensed Trustee. They will guide you through the process and be with you every step of the way.

Choose a trustee with whom you can file a proposal

A Licensed Insolvency Trustee will file a consumer proposal on your behalf in a way that will appeal to your creditors.

A consumer proposal is a legally binding agreement that all creditors must abide by. Therefore, creditors do not accept a proposal that hasn’t been filed correctly.

While under a proposal you are protected by a “stay of proceedings”. This means that creditors are no longer allowed to contact you for collections.

Once approved, diligently follow the repayment plan

It is important to make sure you pay every month, without fail. You need to make sure you don’t miss even a single payment or it can reflect negatively on your credit score.

You also need to attend two mandatory financial counselling sessions.

What happens after a consumer proposal?

After you make the payments, you will receive a certificate showing that you have fulfilled all the terms of the agreement. It also shows that you do not owe any balances or any more money on the debts covered in the consumer proposal.

If the only debt you hold is unsecured, then you could be debt-free after you’ve paid off your consumer proposal!

Can I pay it off earlier than the scheduled plan?

You can pay off a consumer proposal earlier than scheduled. You’ll get out of debt sooner, and your credit report will also be able to bounce back sooner.

There are many ways to do this, like increasing your payment amounts or your payment frequency. You can also make a lump sum payment whenever possible.

What happens if you miss a payment?

Presently, you are allowed a maximum of three missed payments throughout the entire duration of the consumer proposal. If you miss three payments and do not file an Amendment, the proposal becomes void.

This means that the agreement is no longer legally binding. Therefore, creditors will not be bound to the terms, and are free to pursue action against you for the full amount.

Consumer proposals vs. other debt-relief options

Credit counselling

Credit counselling is often preferable to consumer proposals when it comes to smaller amounts of debt. If you owe under $20,000, or ideally under $10,000.

If paying back the full amount of your debt is doable with your budget, credit counselling might be preferable. The biggest benefit of credit counselling is that interest is negotiated down drastically, often to 0%.

If you are unable to pay the total debt amount fully, a consumer proposal might be better for you.

There are many other pros and cons to consider, so do your research and speak to a counsellor to find what works best for you.

Debt Consolidation

If you are struggling, but able to keep up with your bills and have a good credit score already, debt consolidation might be a good option for you.

It involves consolidating all your separate debts into one loan with a lower interest rate. Essentially, you would be taking out a lower-interest loan in order to pay back all your higher-interest debts. This would help you get out of debt faster as you would be able to pay back a lower-interest loan quicker and with a lower overall interest amount.

A debt consolidation loan does not affect your credit score the way a proposal or bankruptcy would.

Bankruptcy

Compared to bankruptcy, consumer proposals have many relative benefits:

- During a bankruptcy, your assets and employment income, depending on where you live, can be subject to being sold to pay creditors back. However, when doing a proposal, they can no longer lay claim to your income or assets.

- Interest is no longer applied to any debts that were covered under the proposal. This helps reduce the amount you owe to a great extent.

- The effects on your credit score are removed in a few years.

- You can rebuild your credit rating at a quicker rate, making it easier for you to borrow in the future for large ticket purchases, like a home or a car.

Key Takeaways

Consumer proposals in Canada are an effective debt relief strategy. It is a debt settlement arrangement negotiated by a Licensed Insolvency Trustee and a preferable alternative to filing for bankruptcy.

It is a legally binding document that all your creditors must abide by. Generally, it reduces your total debt amount by a large percentage – often up to 70 or 80 percent.

To qualify you must have between $1,000 to $250,000 in unsecured debt. For a married couple choosing to file jointly, the amount increases to $500,000.

A consumer proposal does negatively affect your credit score, but less than filing for bankruptcy.

The consultation might provide you with greater insight into whether a consumer proposal is right for your specific situation. However, thare other options like debt consolidation, debt settlement, and credit counselling that may be worth considering.

If you do choose to file a consumer proposal, creditors who hold over 51% of the value of your debt must vote to accept for it to be court-approved. Afterwards, you need to make regular monthly payments and attend two mandatory financial counselling sessions.

If you miss a payment, it will affect your credit score. Overall, you are allowed to miss up to three payments through the duration of the consumer proposal. If you miss three payments without filing an Amendment, your consumer proposal will then become void.

To make a more informed decision, speak to a trustee. Once they understand your financial situation, they can help you decide whether a consumer proposal is right for you.

Frequently Asked Questions

You must be filing as an individual. Ensure your debts are between $1,000 and $250,000. You must be able to show that you’re not in a financial position to be able to pay your debts. You must also have a regular income source to show them that you can make the monthly payments on time.

Businesses are not eligible to file consumer proposals, although they can file for a Division 1 proposal irrespective of the amount. If you’re an individual with debt higher than $250,000, you would also be able to file a Division 1 proposal. Division 1 proposals are filed through a Licensed Insolvency Trustee.

In most cases, an annulment is due to failure to pay. If you miss three months of payments through the entire duration of the proposal, there is an automatic annulment. To avoid an annulment, pay every month on time, and don’t miss a single payment.

An annulment has serious consequences. Specifically, any money you’ve already paid to creditors will not be returned to you. You will also be charged the penalties, fees and interest charges for the entire amount.

It’s best to talk to your trustee right away if you’re having a tough time making payments. They will help guide you through your options.

It is possible to file a consumer proposal jointly with your spouse. If you have overall household debt and your spouse is affected, you can file jointly. In this case, creditors and collections cannot pursue your spouse for payments as both of you would have filed the proposal.

If you file a consumer proposal jointly in Canada, you can file for up to $500,000.

A consumer proposal would work well for you if you have a high amount of unsecured debt and a regular income. Creditors would be more inclined to approve the proposal as well, as they know you have the income to make consistent payments.

Consider other alternatives, such as debt settlement, debt consolidation, or credit counselling, and make an informed decision.