Whether you are in a long-term relationship or are just getting started with someone new, dating can, unfortunately, take a large toll on your wallet. The last thing you want to do is be cheap on a date, but that doesn’t mean you should go further into debt just to impress someone. Finding budget-friendly activities just requires thinking a bit outside the box.

Depending on the city you live in, there may be entire worlds waiting for you and your significant other to explore.

Look Into Free Events

Always stay up to date on the free events that are happening in or around your city. Don’t be afraid to explore things that you have otherwise never experienced before. This is a wonderful way for you and your partner to discover new things and see what you like (or don’t like!).

Concerts

Where a concert ticket could cost upwards of $200 for both of you, there may be a local show that will be much more intimate and just as fun. No matter either your tastes in music or the size of the city you live in, there are always local venues looking to gain more support that can benefit just from your willingness to be there.

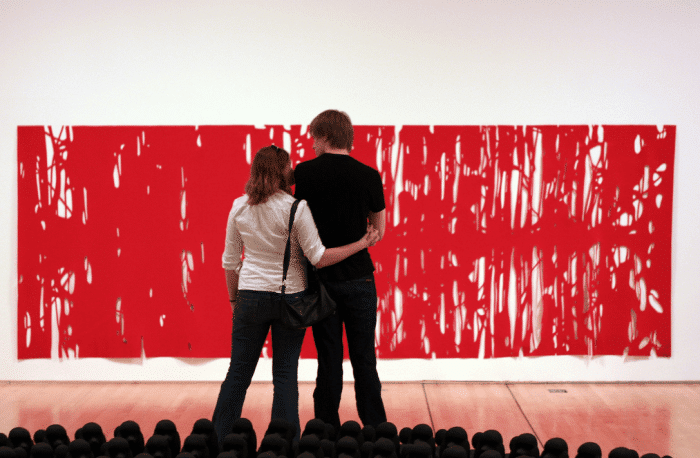

Museums

Although a museum might not be your first choice, it can actually be a fun bonding experience. Whether you’re interested in natural history or an art exhibition, there is a good chance that your city is home to a museum or show that offers free admission at some time during the week. It’s a fun way to explore the rich history of your city or making judgment calls on pieces of art together.

Nature

An often-overlooked means to adventure, there are an endless amount of parks and trails at your disposal that can easily eat away more than just one afternoon. Whether taken by foot or bike, natural surroundings that offer a beautiful background to your date night are something that simply can’t be bought. Even though some national parks may have a fee attached, it would still be cheaper than a night in the city.

Think About the Available Alternatives

If you are still in search of something that fulfills the relationship you have with your partner a bit more, there is still hope for dating to be done on a budget. Although these will obviously come at a price as opposed to the options listed above, they are still going to be cheaper than the expensive default option.

Restaurants

While it may be appropriate to dine out at an expensive restaurant during an important anniversary or birthday, the weekly date definitely does not have to be supported by a $100 bill at the end of the night. You don’t even have to use coupons to eat cheaper and at a nice place – it can be as simple as finding a local restaurant to support, which benefits both you and your partner and the owners. These places can oftentimes be just as romantic as a “brand name” restaurant while offering a more intimate scene and saving you some money in the process.

There is also the option of cooking at home or having a picnic. These are great bonding experiences with your partner and are much cheaper than eating out.

Movies

Instead of deciding to go see the newest flick opening in theatres at midnight and wasting an insane amount on concessions, consider having a movie night in. You could even load up a DVD on your laptop and spend the night outside. Both of you would get to choose the films and have a relaxing night spent together, without having to worry about everything extra that is attached to going to the theatre.

Thinking outside the box is the key to getting the art of dating frugally down. There is always an alternative available that will cost less and most likely offer you the chance to get to know your partner in a way that you have otherwise not been able to.

The money you save can be used to take the stress off of any impending debt that you may have. As your relationship progresses, having some conversations about money will definitely occur, and hopefully, your partner understands your long-term goals and supports them.